In this Article

In the dynamic field of financial markets, the five-year prediction period stands as a vital timeframe, integrating principles of alert and strategic investing in stark contrast to the wild pace of day trading and academic trials.

As we enter 2024, a time formerly shadowed in the US by enterprises of a market crash and dragged underperformance, the geography has dramatically shifted. Recent market adaptability and the expanding breadth of rising stocks indicate a positive line, setting the stage for promising US stock market predictions for the next five years.

This paper delves into the complications of the current profitable geography, examining macroeconomic maps and predictions that bolster a specially auspicious outlook. Beyond the immediate horizon, a deeper disquisition reveals a long-term vision gauging the coming 5 to 10 years, characterized by sustained growth in US manufacturing and invention.

Also, there’s a noteworthy profitable shift marked by a strategic decoupling from China, where the United States, buoyed by raised credit rates and a commitment to domestic products, positions itself as a stalwart protector of its markets.

Join us as we navigate the complications of the US stock market predictions for the next five years (2024–2028), where strategic investments and technological prowess meet to shape a satisfying narrative of growth and adaptability.

Review of 2023: US Stock Market Performance

In 2023, the financial markets faced a noteworthy chapter of query and apprehension. Enterprises primarily revolved around the eventuality of a market crash and the expectation of prolonged underperformance.

Investors were conservative, precisely assessing global profitable indexes and geopolitical events that had the implicit ability to impact market dynamics significantly.

The crucial enterprises were market stability and global profitable factors. Investors were cautious of signs indicating a lack of stability in the fiscal markets.

On the other hand, global profitable factors, such as trade pressures, geopolitical conflicts, and profitable decelerations in certain regions, contributed to apprehension.

The recap of 2023 US stock market performance will help comprehend US stock market predictions for the next five years.

Despite the original concerns in 2023, the financial geography displayed a remarkable changeover as time progressed. Shifting sentiment became apparent, fueled by factors that implanted confidence among investors.

We looked at some positive indexes: Market adaptability and Improving economic data. The markets showed adaptability in facing challenges, bouncing back from initial lapses. Also, positive economic indexes, including robust commercial earnings and perfect employment numbers, contributed to a more encouraging outlook.

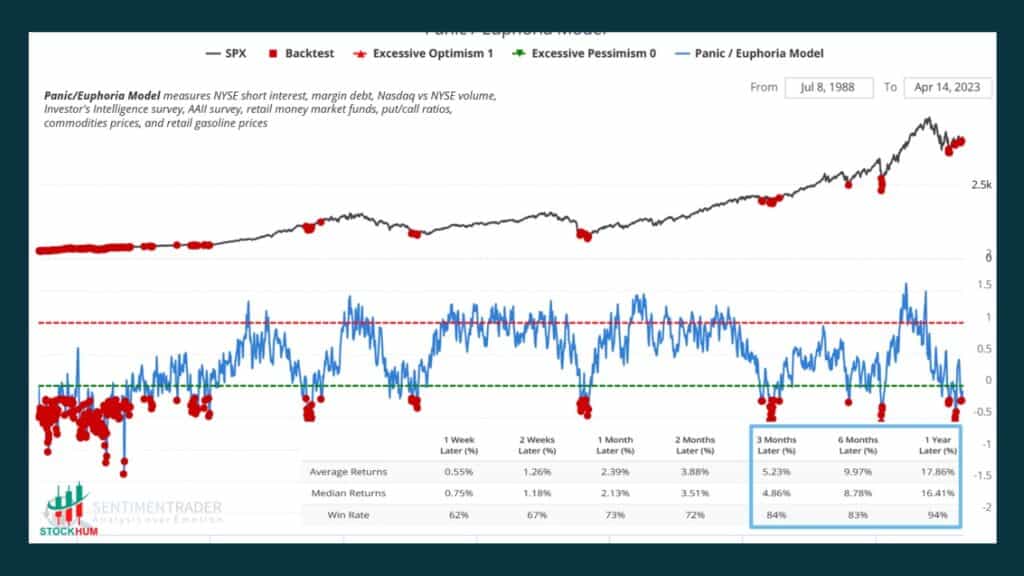

Keeping a close eye on investor sentiment provides precious perceptivity into implicit openings. The Panic Euphoria model, which considers factors like short interest, Put/ Call rates, and checks, helps indicate market sentiment.

In the map, when the model hits extreme pessimism( marked by red dots), literal data shows that buying S&P 500 shares at those points resulted in an average return of 17.89 one time later, 94% of the time. Using this model during extreme pessimism has historically proven beneficial for investors. It showcases the value of understanding and using sentiment pointers.

Market Performance: November 2023

| Category | Performances |

| Total return of S&P 500 | 21% for the year, breaking the mean periodic return of 10%. |

| Sector Performances | Technology, communication services, consumer optional stocks, and growth stocks rebounded significantly. |

| Indicator Performances | Nasdaq Composite gained 37%, and the Dow Jones Industrial Average over 11%. |

| High Performing Sectors | High-growth, cyclical technology, telecom, and consumer optional sectors led the S&P 500. Protective sectors like serviceability, healthcare, and consumer masses lagged before. |

Banking Crisis: Spring,2023

At the beginning of 2024, the stock market endured an indigenous banking extremity, shaking investor assurance. Over numerous weeks, losses in cryptocurrency investments, sharp downturns in bond portfolios, marketable real estate values, and aggressive bank deposits.

It collapsed and created the Argentine Gate Bank, Silicon Valley Bank, Hand Bank, and First Republic Bank crisis. Regional bank stock prices declined, raising enterprises of contagion spreading to other banks.

U.S Reserve Intervention

Fussing a broader extremity, the Federal Reserve swiftly interposed. Emergency loans were extended to upset banks, securing financial stability. Customers of failed banks were assured by the central bank that their deposits would be fully recovered, surpassing the $250,000 insurance guaranteed by the Federal Deposit Insurance Corporation.

Larger banks, analogous to JPMorgan Chase and New York Community Bancorp, played an essential part by acquiring the means of the failed banks.

Consolation and Resolution

Simultaneously, Federal Reserve Chair Jerome Powell and U.S. Treasury Secretary Janet Yellen took a visionary way to assure the public. Their harmonious messaging emphasized the stability of the banking sedulity and the safety of deposits. The crisis concluded with minimal disturbance to equity markets.

Best and Worst Performer Stocks of 2023: The Result of Success and Struggle

As 2023 draws close, the S&P 500 has experienced a remarkable time for investors, marked by noteworthy performances and many underwhelming showings. This overview highlights notable stocks in both orders, showcasing the best and worst performers within the S&P 500 indicator.

| Best Performer Stocks | Total Gain | Worst Performer Stocks | Total Gain |

| NVDA | +220% | SEDG | -72% |

| META | +172% | ENPH | -62% |

| RCL | +117% | FMC | -56% |

Pointers Advocating a Favorable 2024 Stock Market Forecast

1. Profitable Growth and GDP Expansion

Positive economic pointers, including GDP growth, job creation, and consumer spending, are foundational for a wholesome stock market. Protrusions of continued profitable expansion in 2024 are a promising sign.

2. Commercial Earnings Outlook

Strong commercial earnings frequently reflect a healthy business terrain. Critic predictions and early earnings reports indicating harmonious or advanced commercial performance can inseminate confidence among investors.

3. Interest Rates and Monetary Policy

The central bank station, particularly the Federal Reserve, plays a pivotal part. Favorable conditions, like low-interest rates or well-managed financial programs, encourage borrowing, investment, and stock market growth.

4. Inflation operation

Effective control of inflation is vital. Moderate inflation rates are generally favorable for stock markets as they stabilize and ensure the currency’s purchasing power remains complete.

5. Global Economic Stability

A stable, profitable global terrain, with flexible requests beyond domestic geography, can contribute appreciatively. Reduced geopolitical pressures and steady growth in major frugality

contribute to a favorable background.

6. Technological Advancements and Innovation

Investment in cutting-edge technologies, similar to artificial intelligence, robotization, and other inventions, frequently indicates a forward-looking and competitive frugality. Companies leading in technological advancements can drive market sanguinity.

7. Consumer assurance and Spending

High consumer confidence is linked to increased Spending, which, in turn, stimulates profitable exertion. Positive sentiment among consumers can be a commanding index of sustained market growth.

8. Market Breadth and Sector Performance

A broad-grounded rally with multiple sectors sharing indicates a healthy market. Examining the performance of colorful sectors and diligence provides perceptivity into the overall strength and adaptability of the market.

9. Panic Euphoria Model and Investor Sentiment

Monitoring investor sentiment, as measured by models like the fear Euphoria Model, can offer perceptivity into market action. Axes in sentiment, if well-managed, may present contrarian openings.

10. Global Trade Dynamics

The state of global trade, trade agreements, and political relations can impact market conditions. A positive outlook for global trade can boost confidence in transnational corporations and contribute to market growth.

These pointers give a comprehensive view of the profitable geography and investor sentiment, offering precious perceptivity into the implicit line of the stock market in 2024.

How to Predict Stock Market Performance?

Predicting stock market performance involves a multifaceted way, combining fundamental analysis, specialized pointers, and macroeconomic factors. Fundamental analysis assesses a company’s fiscal health through earnings reports and tip history.

Specialized analysis involves studying price maps and patterns for implicit trends. ProfitableProfitable pointers such as GDP growth and severance rates give perceptivity to broader market conditions.

Monitoring investor sentiment, global events, and sector trends aids in anticipating market movements. Some employ quantitative models and algorithms, exercising data analytics and machine learning. Successful forecasts frequently affect a holistic understanding of colorful factors and ongoing strategy adaptations.

Still, it’s pivotal to admit the essential uncertainties in fiscal markets and incorporate threat operation strategies, similar to diversification and stop-loss orders, for a prudent approach to investing.

US Stock Market Predictions for Next 5 Years: Analysis of NASDAQ

Predictions of NASDAQ for 2023-2024

In 2023, the NASDAQ experienced numerous ups and downs due to global profitable issues and harmonious interest rate hikes by central banks. This caused the NASDAQ compound indicator to experience some difficulties.

Still, there is an opportunity as dealers anticipate a change in the Federal Reserve’s approach, conceivably with interest rate cuts at the end of the year. However, if this happens, the stock market might show strength towards the time’s end.

Looking ahead to 2024, it’s anticipated that the NASDAQ 100, including the top 100 companies in the NASDAQ, will surpass recent highs and the overall indicator. In the long term, if the Federal Reserve eases its financial policy, the NASDAQ could see a positive trend, especially as traders seek returns from high-performing stocks.

Five years predictions of NASDAQ until 2028

Analysts are hopeful about the NASDAQ’s growth over the coming five years despite the eventuality of occasional corrections. The market witnessed a sell-off in 2022 and 2023, causing some dislocation.

Still, examining the long-term trend reveals a sustained uptrend measuring decades. The market’s maturity underscores the vital part of liquidity, with the Federal Reserve’s financial policy taking center stage. The looser the policy, the more favorable the outlook for the NASDAQ.

Despite a significant withdrawal, when viewed through the lens of the longer-term trend, it appears as a typical bear market withdrawal rather than a signal of a prolonged downturn. Navigating the NASDAQ involves covering the Federal Reserve’s policy opinions, emphasizing the significance of liquidity in shaping the market’s line over the coming five times.

Fig: 5 years predictions of NASDAQ until 2028

Source: https://primexbt.com/for-traders/nasdaq-price-prediction-forecast/

| Year | Forecasted Price |

| 2023 | 14000 |

| 2024 | 15000 |

| 2025 | 15500 |

| 2026 | 17500 |

| 2027 | 18000 |

| 2028 | 19500 |

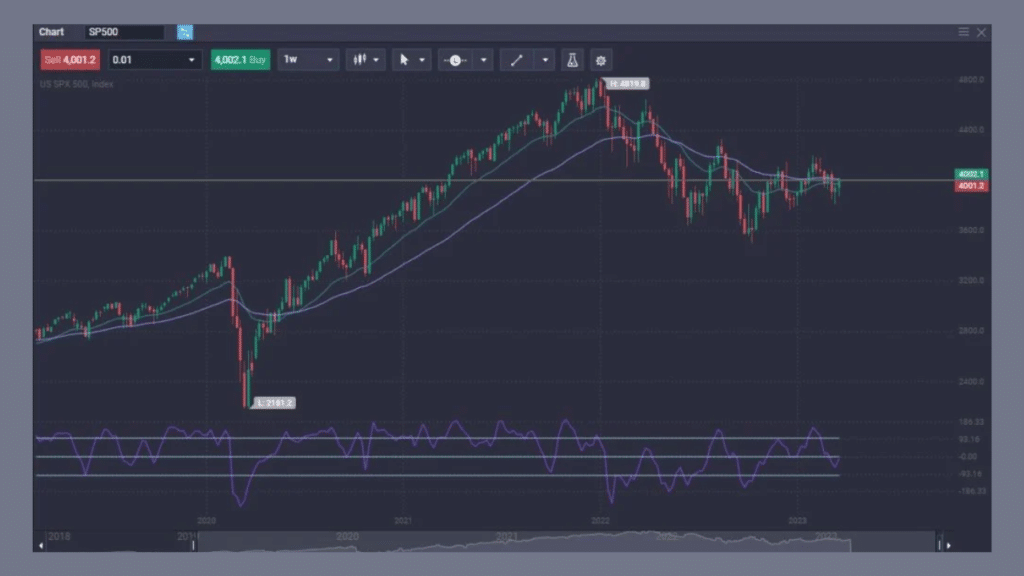

US Stock Market Predictions for Next 5 Years: Analysis of S&P 500

Predictions of S&P 500 for 2023-2024

Because of the numerous variables at play, approaching any assessment of the S&P 500 for 2023 with extreme caution is required. Despite the sensitivity demonstrated in the first three months of this year, it is critical to keep a nuanced perspective.

While current short-term performance may appear sensitive, a longer historical perspective demonstrates excellent outcomes for investors. Considering the Federal Reserve’s favorable position during the previous 14 years is critical.

The statement-making money for US investors with few options becomes more relevant in the context of persistently low-interest rates.

Still, the fiscal situation has most clearly changed, as the Federal Reserve has started to strain financial policy. lately

In the past, growth stocks thrived due to abundant funding flowing into startups and rapidly developing nations. However, a bear market has permeated traders’ psychology, leading many chasing “easy money” to incur losses.

Tom Lee, Head of Investments at Fundstrat Global Advisors, forewarns of challenges for the S&P 500 in 2023 as a potential Federal Reserve policy shift looms. Despite a temporary disruption, Lee expects a resurgence in the third quarter, projecting an ascent to 4200 after overcoming initial downward pressure.

Jim Cramer predicts the S&P 500 at 4100 in 2023, anticipating favorable Wall Street data to prompt the Federal Reserve to ease financial policy. Enterprises arise as banking system stress increases, leading to a potential shift into a “bad news is good news” market phase, evocative of post-Great Financial Crisis times concentrated on liquidity rather than earnings growth.

5 Years Predictions of S&P 500 until 2028

The current premise is that the S&P 500 will continue its rally, although predicting the unknown is grueling, as demonstrated by the unanticipated impact of the global epidemic on the market. Despite misgivings, literal trends show a general upward line over time, emphasizing the adaptability of the S&P 500.

The S&P 500 remains an attraction for global investment, given its maturity and broad trust compared to other stock indicators. Map analysis suggests a robust withdrawal in 2023, raising questions about eventual further declines. Still, literal data indicates that markets tend to rebound, and by 2028, making new highs is a presumptive anticipation.

Some experts anticipate a substantial rise, conceivably reaching 5000 in the coming times, with bolder predictions suggesting a swell to 10,000 by 2028. The crucial determinant in achieving this could be the strength of the US dollar, as a significant decay may contribute to the envisaged market highs.

This underscores the significance of nearly covering global profitable factors that could shape the S&P 500’s unborn line.

Fig: 5 years predictions of S&P 500 until 2028

Source: https://primexbt.com/for-traders/s-p-500-price-prediction-forecast/

| Year | Predicted Price |

| 2023 | 4200 |

| 2024 | 4900 |

| 2025 | 5500 |

| 2026 | 5700 |

| 2027 | 6000 |

| 2028 | 6525 |

Macro Economic Analysis of US Market Predictions for Next 5 Years

US GDP Predictions for the Next 5 Years

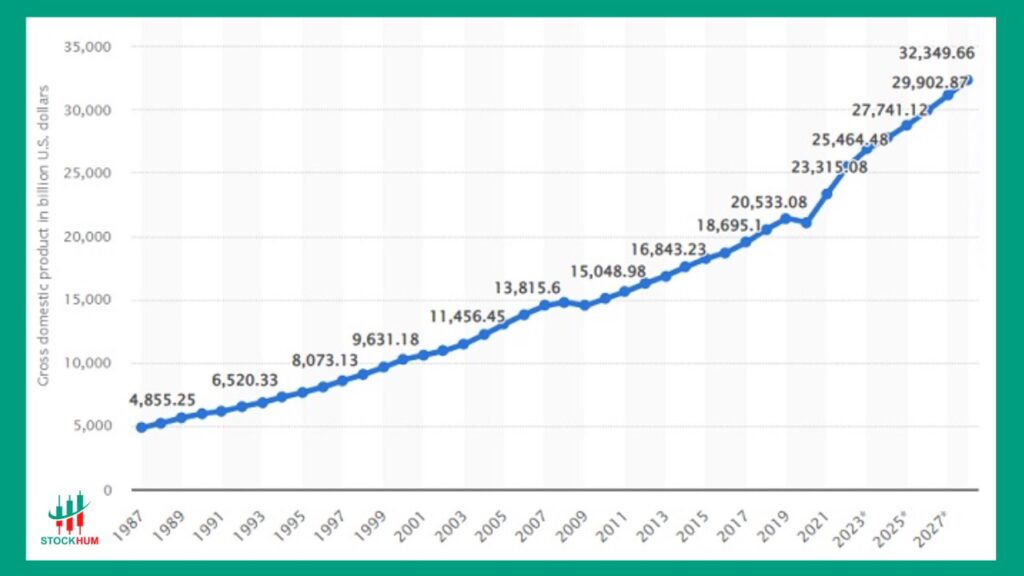

Fig: US GDP Prediction for next 5 Years According to Statista.

US Unemployment Report

Fig: Unemployment Prediction for USA according to Trading Economics

US GDP Prediction

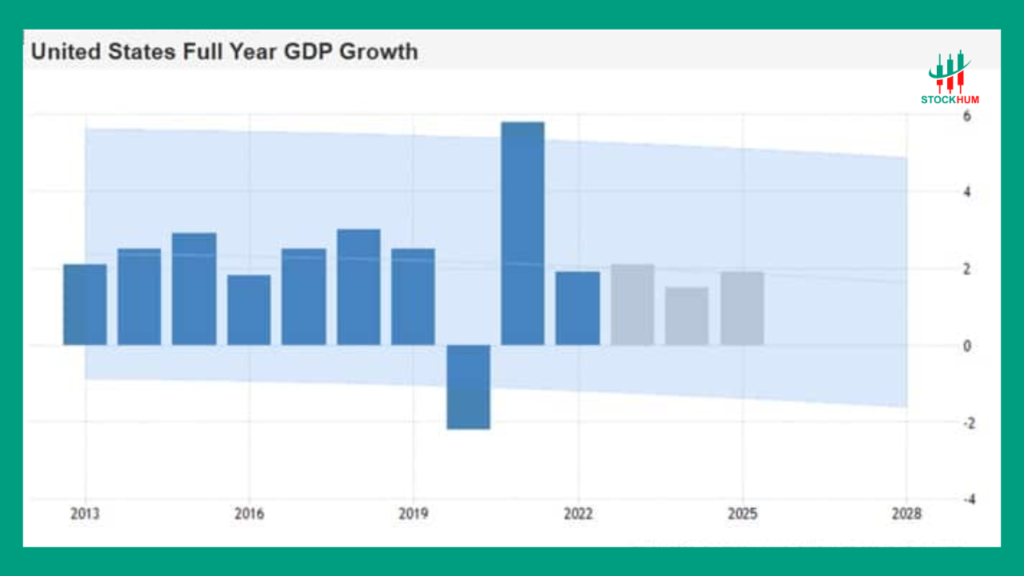

Fig: US GDP Prediction: declining to 2028

Conclusion

The US stock market for the next five years appears promising, but it comes with recognizing potential uncertainties. The adaptability in the face of challenges like the 2022- 2023 sell-off and the global epidemic indicates the request’s capability to recover.

While short-term oscillations are ineluctable and grueling to predict, literal trends suggest an overall upward line in the longer term.

Investors should remain aware of factors like the Federal Reserve’s financial policy and liquidity situations, as these are pivotal in impacting request conditions. The S&P 500’s maturity and global trust continue to attract significant flux, making it a crucial player in the request’s movements.

Chart analysis indicates retreats, viewed as part of regular market cycles rather than signals of prolonged downturns. The NASDAQ, with its focus on technology and invention, is anticipated to thrive, especially with prospects of advancements in AI and microchips furnishing a sustainable advantage.

As with any market prediction, it’s essential to approach investment opinions cautiously, diversify portfolios, and acclimatize strategies grounded on evolving profitable geographies. While predictions suggest growth, unlooked-for events can impact issues.

Thus, staying informed, maintaining a long-term perspective, and regularly reassessing investment strategies will be pivotal for navigating the dynamic geography of the US stock market in the coming years.

Will the Stock Market Recover in 2024?

Cronk from Wells Fargo concurs, suggesting investors prioritize large-cap stocks as lower and mid-cap stocks are anticipated to face challenges amid profitable retardations. As 2024 progresses, Cronk suggests that investors shift their focus to further high-threat asset classes, anticipating a recovery in the U.S. frugality from its original weakness in the first half of the time.

Is It Time to Buy Stocks?

Now is a rational time to buy stocks if you can invest for five, ten, or forty years. Indeed, with patient fears of a recession, it’s essential to remember that the market is forward-looking. Unborn earnings prospects are a crucial factor in stock pricing.

Is It Worth Investing in Stocks?

Allocating Finances to U.S. stocks broadens request exposure, minimizes threat, and has the implicit to boost returns, enhancing overall portfolio performance mainly.

Is It Reasonable to Hold Stocks for Ten Years?

Analyze the business section and factual track record of the company in detail. Remarkably, profitable equities from respectable companies constantly produce long-term solid returns over ten times, pressing the need for thorough disquisition.

What Stock will Double in 2024?

NIO stock enjoys popularity among both retail investors and sell-side analysts. Two analysts anticipate the stock doubling in value by 2024. For example, Morgan Stanley’s Tim Hsiao sets a target price of $18.70, representing a 151% increase from the current situation.

References

1. Collins, G. (2023, December 9). 5 Year stock market forecast: Outlook for 2024, 2025 2026 2027. Housing Forecasts & Stock Market Forecast. https://gordcollins.com/stock-market/5-year-stock-market-prediction/

2. PrimeXBT. (2023, December 20). NASDAQ 100 forecast for 2023, 2024, 2025-2030. https://primexbt.com/for-traders/nasdaq-price-prediction-forecast/

3. S&P 500 (SPX) forecast for 2023, 2024, 2025-2030. PrimeXBT. (n.d.). https://primexbt.com/for-traders/s-p-500-price-prediction-forecast/

4.US markets: US Stock Market Data – Dow Jones, NASDAQ, S&P 500, US market news – moneycontrol. English. (n.d.). https://www.moneycontrol.com/us-markets/5.Yates, T. (n.d.). 4 ways to predict market performance. Investopedia. https://www.investopedia.com/articles/07/mean_reversion_martingale.asp