In this Article

Welcome to the exciting universe of predicting stocks! Still, you may need clarification if the stock is rising or falling. This guide is here to help you learn the basics of how to predict if a stock will go up or down in a simple way.

Investing is like a roller coaster—pleasant but full of ups and downs. We’ll disintegrate the mystery of predicting if a stock will go up or down. Do not fear; we’ll keep it simple to understand. Let’s dive into the innovative forecasting world in the stock market together!

In this guide, we’ll use a simple way to predict stock movements. While predicting the market is difficult, we’ll adopt introductory strategies centered on primary and specialized factors.

This will give you a solid concept of how stock prices work. Whether you are aiming for fiscal success or just curious, please join us as we deliver simple principles and tips to help you understand how to predict if a stock will go up or down.

How do You Predict if a Stock will Go Up or Down? Real-Life Guidelines

Predicting if a stock will go up or down is challenging and involves a degree of uncertainty. It can influence stock prices by examining colorful data and factors. Factors like volatility, low-float stocks, volume, MACD, average, RSI, and RVOL play vital roles in predicting possible stock movements. Learning how to explain and work these pointers can enhance your ability to predict when a stock will likely go up or down.

Volatility:

The quantum that a trading cost series varies over time is applied to its volatility. It’s generally used to scale the threat or uncertainty associated with the cost movements of a fiscal instrument, such as a stock. One way to calculate volatility is by applying historical price data and statistical methods, frequently engaging standard deviation.

Investors frequently look at historical volatility by analyzing price movements to predict if a stock will go up or down. However, it’s considered to have high volatility, indicating a more extraordinary eventuality for future price swings if a stock has endured frequent and significant price changes in its history. On the other hand, low historical volatility suggests more stable price movements.

Implied volatility, deduced from option pricing, reflects market prospects for future volatility. Advanced implied volatility refers to anticipated more significant price changes, while lower implied volatility suggests prospects of more stable prices.

Volatility Impacts on a Stock:

Two types of volatility impact the prediction of whether a stock will go up or down in the real-life stock market.

These are:

- High Volatility: Investors might face increased threats and uncertainty. It provides both chances and challenges. It has the probability of advanced returns but also advanced losses.

Example: Suppose a tech company’s stock experiences unexpected and large price swings. However, if news breaks about a significant product launch, the stock might launch significantly, showcasing high volatility. Investors could apprehend openings during dips, hoping for physical earnings if the anticipated positive instigation materializes.

- Low Volatility: Generally associated with more stable prices, it gives a sense of predictability. Investors may detect it as less dangerous but have low short-term trading chances.

Example: Consider a utility company’s stock known for its soundness and minimum price fluctuations. However, without significant spikes or drops, it reflects low volatility if it moves gradually and predictably. Investors seeking a quieter approach might find this stock appealing for its immutability, but the eventuality for rapid-fire earnings is restricted.

The formula of Calculation:

A daily periodic stock return( expressed below as UI) is the return from history to moment. Note that if there were an extra, we’d add it to the moment’s stock price.

The following formula is applied to compute this probability:

(ui = Si−Si−1| Si−1)

Where: ui = daily periodic stock return

The formula for predicting stock movement:

Predicted Price = Current Price × e^(Volatility × Time)

The formula shows that higher volatility or a longer period would affect various possible prices. This status increases the query of the future.

Remember, while volatility can give perceptivity, it does not guarantee stock movements, and external factors can impact price tags suddenly.

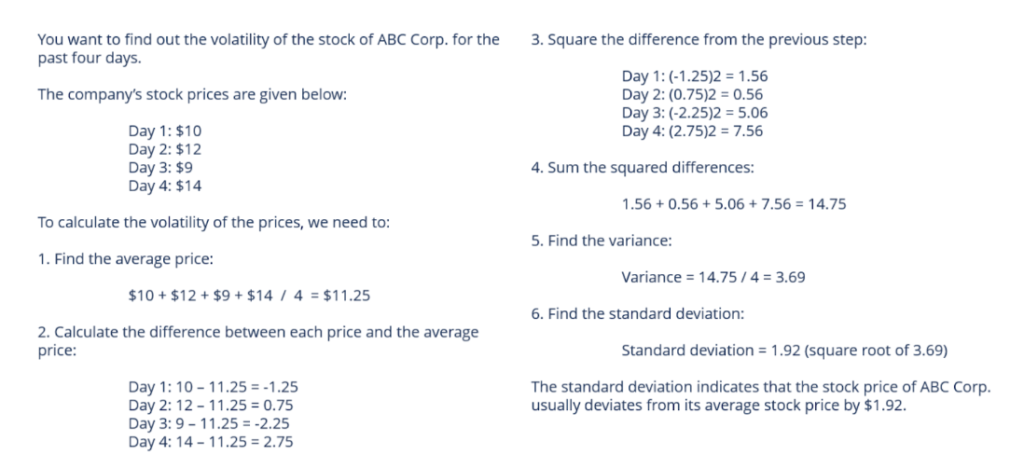

Calculating Volatility:

Here are seven steps to be followed when computing volatility by deciding the standard deviation over time.

Step 1: Collect the historical costs of the asset.

Step 2: Calculate the anticipated cost ( mean) of the historical costs.

Step 3: Work out the discrepancy between the mean cost and each cost in the series.

Step 4: Square the differences from the former step.

Step 5: Decide the total of the squared differences.

Step 6: Divide the differences by the grand number of costs (determine friction).

Step 7: Figure the square root of the friction calculated in the past measure.

The image below illustrates an illustration of a volatility calculation:

These formulas will help beginners comprehend how to predict if a stock will go up or down.

Investors Strategies:

Investors frequently engage in different strategies based on their evaluation of volatility and how to predict if a stock will go up or down. Here are two familiar ways:

1. High-Volatility Strategy

- Opportunistic Buying: During high volatility, investors may take advantage of price dips to purchase lower-priced stocks, expecting future upward movements.

- Options Trading: Experienced investors might apply strategies to subsidize unpredictable price movements. For illustration, they may engage straddles or strangles to benefit from anticipated price changes, irrespective of the direction.

2. Low-Volatility Strategy

- Buy-and-hold: In low-volatility stocks, investors may borrow a buy-and-hold strategy, aiming for long-term base appreciation. The stability allows for a more predictable investment context.

- Dividend Investing: Low-volatility stocks, frequently associated with additional established companies, may appeal to income-concentrated investors who increase extra payments and lower risk.

Effects of volume for forecasting stock movement

‘Volume’ is a vital indicator in the stock market, meaning the number of shares traded over a specific period. High volume frequently accompanies meaningful price movements, indicating increased interest and participation in an individual stock. It helps you understand how to predict if a stock will go up or down.

Here are six ways volume impacts stocks and helps predict price movements.

1. Evidence of Trends: High volume during an upward or downward trend can verify the strength of that trend. However, it suggests strong buying interest, supporting the liability of further price increases if a stock is rolling out with a high volume.

2. Price lapses: Unanticipated spikes in volume can gesture a possible reversal in the prevailing trend. For illustration, a swell in volume during a downtrend might indicate increased dealing pressure, conceivably leading to a reversal or a more prolonged deterioration.

3. Breakouts and Breakdowns: Breakouts( price moving above an opposition level) or breakdowns( price moving below a support level) accompanied by high volume are considered more meaningful and dependable. It suggests that the price motion is supported by substantial request participation.

4. Stocks Volatility & Liquidity: Stocks with advanced mean trading volumes tend to be more fluent, making it simple for dealers to buy or vend shares without significantly affecting the stock price. Low-volume stocks may witness less price volatility.

5. Climax pointers: Extremely high volume, specifically during a rapid-fire price movement, can signal a climax or burnout in the current trend. This may precede a reverse or a period of connection.

6. Divergence: When the price and volume display divergent trends (e.g., rising prices with dwindling volume), it might denote weakening instigation and a possible reversal.

It’s important to note that while volume is a precious tool, it should be used in confluence with other specialized and elemental analyses. Factors such as news, earnings reports, and overall market conditions also play a pivotal function in selecting stock movements. Volume alone may not always give a complete picture, and careful consideration of colorful factors is necessary for making informed trading opinions.

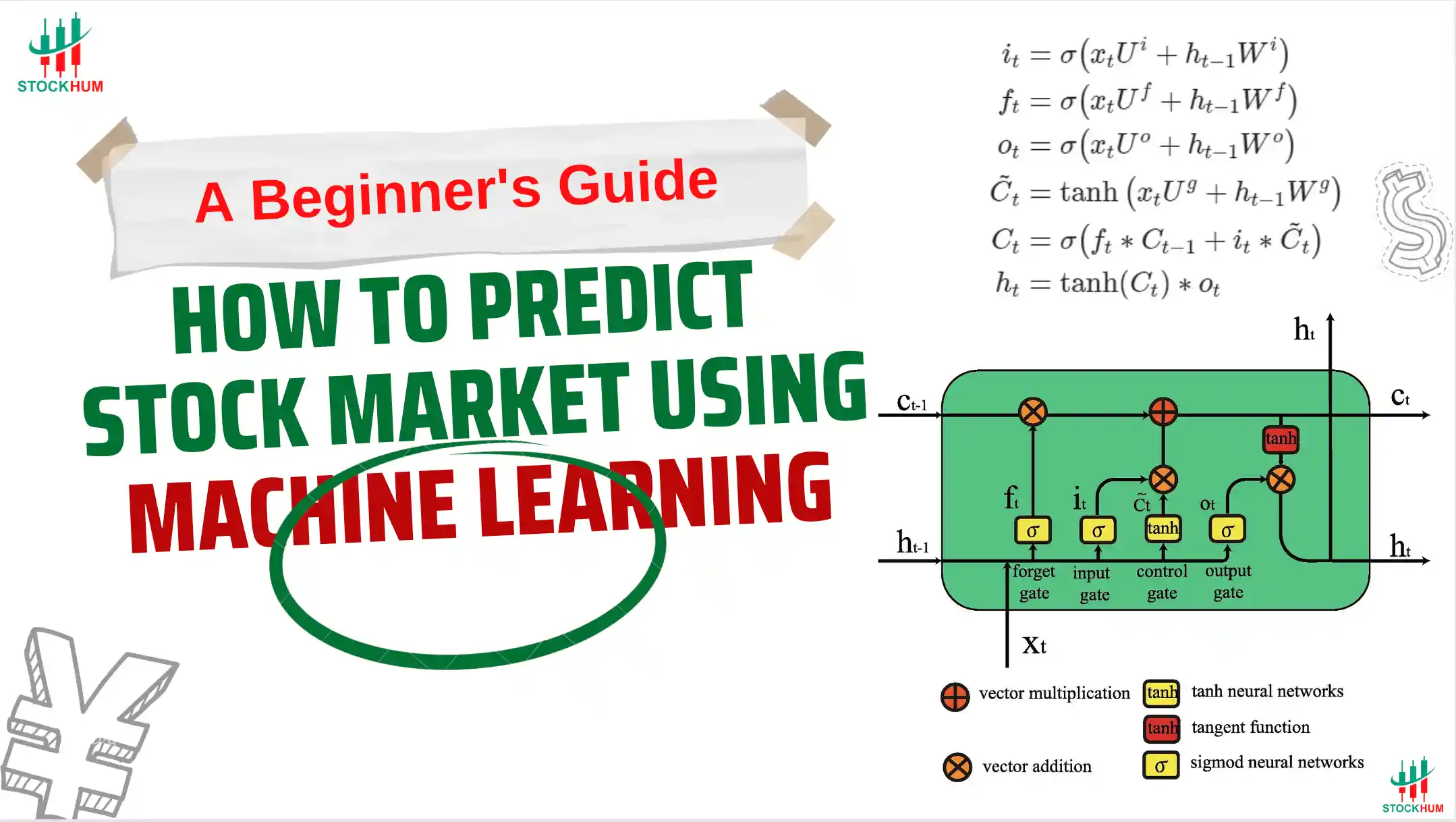

Predictive Indicators for stock movements: (RVOL, VWAP, Moving Average, MACD)

Relative Volume (RVOL), VWAP (Volume Weighted Average Price), Moving Average (MV), and MACD (Moving Average Convergence Divergence) are critical technical indicators used to analyze stock movements and make predictions about potential price directions.

These are the significant pointers that aid you in comprehending how to predict if a stock will go up or down. Let’s explore each one and give individual exemplifications.

Relative Volume( RVOL)

Relative Volume( RVOL) compares a stock’s standard trading volume to its mean volume over a specified period. An advanced RVOL suggests increased exertion and implicit instigation. For instance, a stock with an RVOL of 2 means trading at double its mean volume. An uplifted RVOL, when combined with price movement, may indicate a strong trend.

However, a stock with a high RVOL and an upward price movement could denote a bullish sentiment, potentially moving earnings further.

VWAP ( Volume Weighted Average Price)

“VWAP” is a pivotal indicator that considers both volume and price. It furnishes the mean price at which a stock trades throughout the day, loaded by volume. Dealers constantly use VWAP to assess whether the present price is above or below the average request price.

However, it may suggest a bullish trend, indicating that the stock is being bought at prices higher than usual if the current price is above VWAP. Again, if the price is below VWAP, it might suggest a bearish trend.

Moving Average

Moving averages ( MA) smooth out price data to produce a single fluid line, making it easier to identify trends. There are two most universal types of moving averages. These are Simple moving averages ( SMA) and exponential moving averages ( EMA).

When the market stock price is above its moving average, specifically a rising bone, it indicates an implicit uptrend. Again, if the price is below the moving average, precisely a declining one, it suggests an implicit downtrend. For illustration, a crossover of the short-term EMA above the long-term EMA can signal a bullish trend.

MACD: Moving Average Confluence Divergence

MACD determines how much two exponential moving averages diverge from one another and is a trend-following indicator. The MACD line( the difference) is also facilitated by a nine-day EMA, creating a signal line.

When the MACD line crosses beyond the signal border or line, it generates a bullish signal, indicating implicit upward instigation. Again, a cross below the signal line may indicate a bearish trend. Dealers frequently look for MACD crossovers and divergences to predict stock direction changes.

Now, let’s brief this information in a table:

| No. | Indicator | Prediction Indicator | Example |

| 1. | RVOL | Increased RVOL and Upward Price Movement | RVOL of 2, which indicates trading at twice the average volume and a rising stock price, suggests a bullish trend. |

| 2. | VWAP | Above VWAP for Bullish, Below for Bearish | A stock trading consistently above VWAP may indicate a bullish trend while trading below VWAP may suggest a bearish trend. |

| 3. | Moving Average (MA) | Crossover and Position Relative to MA | Short-term EMA crossing above long-term EMA may signal a bullish trend. Stock trading above a rising moving average indicates potential upward momentum. |

| 4. | MACD | Crossovers and Divergences | The MACD line crossing above the signal line indicates potential bullish momentum. The divergence between price and MACD may signal a trend reversal. |

Combining these indicators can present a more comprehensive analysis of a stock’s implied direction. Dealers constantly use these tools to confirm trends and form reasonable opinions.

Notably, only some indexes guarantee accurate predictions, and a holistic way of counting colorful factors is considered.

Above those indicators is a complete guide for beginners to understand how to predict if a stock will go up or down.

Using Relative Strength Indicator (RSI) for Predicting Stock Movement

A crucial initiating measure often employed in specialized research to evaluate the strength and direction of a stock’s price movement is the Relative Strength Indicator or RSI.

RSI provides a numerical score between 1 and 100 grounded on once price changes. Dealers and investors use RSI to gauge the security of the current price, identify implicit overbought or oversold conditions, and anticipate reversals in the stock’s direction. RSI is the significant indicator that helps you catch on how to predict if a stock will go up or down.

How RSI Works

The RSI is based on comparing the importance of recent earnings to recent losses over a specified period, generally 14 trading days. It resulted in an oscillation value between 0 and 100. A higher RSI score suggests that recent earnings outweigh recent losses, meaning implicit overbought conditions, while a lower RSI score signals implicit oversold conditions.

Predicting upward movement

When the RSI drops below the 30 threshold, the stock is oversold, inferring that its price has fallen significantly and might be due for a reversal. It shows an occasion for traders to anticipate a probability. The probability denotes the upward movement in the stock’s price. The oversold condition suggests that dealing pressure may have been excessive, and a buying chance might arise.

It’s important to note that a low RSI can indicate an implicit upward movement. It must be used in introductory and technical analyses for a comprehensive understanding. RSI alone does not guarantee unborn stock movements. According to market conditions, it works as an essential instrument.

The Relative Strength Indicator, or RSI, is an essential tool. It looks for perceptivity in a stock’s provocation and potential reversals. Monitoring RSI situations, especially when they fall below 30, can help identify openings for upward movements, furnishing a piece of the mystification in predicting stock price changes.

Predicting Downward Movement:

Predicting downward movement in a stock involves a multifaceted route. Technical breakdown plays a key role, with indicators similar to the Relative Strength Indicator (RSI) furnishing pivotal perceptivity.

An RSI above 70 may mean overbought conditions, indicating a possible correction or downcast shift. Similarly, it covers moving standards and trendlines. It helps pinpoint pivotal support situations.

Fundamental analysis is inversely vital in predicting downward movement. It examines fiscal wellness and earnings reports. Assiduity dynamics give a wide medium for expecting unfriendly trends. Stay attuned to market sentiment, common profitable factors, and geopolitical events, as these external influences can significantly impact stock prices.

Effective risk management is essential for predicting downward movement. To minimize hidden losses, set stop-loss orders based on your promise of forbearance. Regularly reassess your prognostications in light of evolving request conditions, developing a dynamic and informed strategy for predicting and responding to downcast stock movements.

Conclusion

Predicting if a stock will go up or down involves a delicate understanding of various factors and pointers. The Relative Strength Indicator( RSI) is vital in this shot by assessing the stock’s current price security, relating to overbought or oversold conditions.

It signals implicit reversals, and the RSI provides precious perceptivity into request dynamics. An RSI value below 30 suggests oversold conditions, inferring an implicit upward reversal.

However, successful soothsaying demands a holistic approach about it. Consideration of fundamental factors, request trends, and external influences complements technical pointers similar to RSI.

A thorough analysis, associating both quantitative and qualitative facets, equips investors and dealers with a complete toolkit for predicting stock movements. It provides justified opinions in the robust world of financial requests.

We have used reliable data in this article to analyze how to predict if a stock will go up or down. This article has helped beginners understand stock price movements.

Real-Life Experiences in Predicting Stock Movement

Hello, I am Hafsa Ahmed. As an investor, learning the art of predicting if a stock will go up or down has been an enchanting adventure. In my experiences, I learned how to predict if a stock will go up or down after investing in the share market.

One memorable experience centered around my reliance on specialized pointers, especially the Relative Strength Indicator ( RSI). Observing a stock with an RSI constantly above 70, I tasted an imminent correction. The request sounded ecstatic, but the RSI gestured for overbought conditions.

A compelling narrative surfaced as I excavated deeper, combining RSI perceptivity with moving paragraphs. The stock, thriving in a bullish trend, faced a tilting point. Trusting my analysis, I decided to take a conservative approach, diversify my portfolio, and set prudent stop-loss orders.

As time passed, the anticipated downturn played out just as I had predicted. Observing the market amendment expansion made me realize how crucial it is to combine an in-depth technical breakdown with a comprehensive understanding of request trends. This immediate experience corroborated the idea that inflexibility and nonstop literacy are crucial.

It bettered my capability to understand the ever-changing world of prognosticating stock motions. The process says it’s about more than ticking to a rigorous path but staying informed and adaptable.

This mix of technical analysis, like keeping an eye on pointers similar to the Relative Strength Indicator ( RSI), along with a holistic grasp of wide market dynamics, has become my strategy’s foundation.

At last, successfully predicting stock movements is about balancing analysis complications and the ever-shifting currents of market sentiment.

FAQs [Frequently Asked Questions]

How do you tell if a stock is going up or down?

To figure out the instructions of a stock, cover its price trend. However, it will likely arise If the stock constantly records advanced highs and lows. Again, lesser highs and lesser lows suggest a downcast line. Specialized pointers like the Relative Energy indicator( RSI) and moving averages can further support predicting future movements.

How do you identify stocks that will go up?

Identify upward-trending stocks by examining harmonious patterns of advanced highs and advanced lows. Conduct a thorough basic breakdown, esteeming strong financials and excrescency eventuality. Use specialized pointers similar to the Relative Strength Indicator ( RSI) and moving averages for more evidence of positive instigation.

What is the most accurate stock predictor?

The ultimate stock predictor varies, but a combination of complete breakdowns involving basic and specialized representatives yields the most accurate predictions. Use tools like Relative Strength indicator( RSI) and moving averages, and stay informed about market trends for a well-rounded path to predicting stock movements.

What indicates that a stock will go up?

A stock’s fee reflects its current market value, determined by the consensus between buyers and merchandisers. With more buyers, prices rise; with more merchandisers, prices fall. The passionate interplay of supply and demand in the market acclimates the stock’s value.

References

- TradingLeagues. (2023, November 26). How to predict if a stock will go up or down?. Medium. https://medium.com/@tradingleagueshq/how-to-predict-if-a-stock-will-go-up-or-down-995c4c219732

- Bullish Bears. (2023, May 8). How to predict when a stock will go up or down. https://bullishbears.com/how-to-predict-when-a-stock-will-go-up/

- Yates, T. (n.d.). 4 ways to predict market performance. Investopedia. https://www.investopedia.com/articles/07/mean_reversion_martingale.asp

- Briefing.com. (n.d.). https://www.briefing.com/learning-center/how-to-predict-if-a-stock-will-go-up-or-down

- Mani. (2023, November 25). How to predict if a stock will go up or down [beginners guide]. GETMONEYRICH. https://getmoneyrich.com/how-to-predict-if-a-stock-will-go-up-or-down