In this Article

Predicting stock prices has been a longstanding challenge in the ever-evolving geography of fiscal markets. Investors, analysts, and dealers constantly seek practical tools to navigate uncertainties and make informed opinions.

Enter the realm of “How to Predict Stock Market Using Machine Learning” – a cutting-edge approach that harnesses the power of artificial intelligence to read market trends.

In this period of data-driven decision-making, machine learning algorithms have proven invaluable in assaying vast quantities of historical stock data, relating patterns, and making predictions.

This article explores the fascinating crossroads of finance and technology, shedding light on how machine-learning models revolutionize how we perceive and interpret market dynamics.

By delving into the abecedarian principles behind How to Predict Stock Market Using Machine Learning, we will clear the complications of this innovative methodology. From understanding the role of literal data and market pointers to the significance of algorithmic learning, we aim to make this transformative technology accessible to everyone.

Join us on a journey where artificial intelligence meets fiscal soothsaying, unleashing a world where predictions become more accurate, opinions more informed, and the changeable nature of the stock market begins to reveal its secrets.

Get ready to navigate the fiscal geography with newfound confidence as we explore the possibilities of Stock Price Prediction Using Machine Learning.

Journey with Algorithms: Predicting Stock Prices Simplified

Predicting stock prices has long been challenging, primarily due to the dynamic and frequently changeable nature of fiscal markets. Traditional ways have struggled to give accurate forecasts, leading to a demand for innovative approaches that can dissect the vast and intricate datasets impacting stock movements.

Challenges in Predicting Stock Prices

Understanding the challenges involved is pivotal for grasping the significance of emerging technologies. Factors like market volatility, external events, and the intricate interplay of colorful, profitable pointers contribute to the complications. Also, mortal conduct, sentiments, and the rapid-fire dispersion of information complicate the task of soothsaying stock prices perfectly.

Enter Machine Learning

Against this background, “How to Predict Stock Market Using Machine Learning“ has surfaced as a promising result. This technology uses artificial intelligence to exercise large quantities of former data, identify trends, and give predictions. Unlike traditional methods, machine learning models can acclimatize and learn from new information, offering a more dynamic and responsive approach to stock market analysis.

Rise of Artificial Intelligence in Financial Markets

The fiscal industry is decreasingly counting on AI to navigate complex stock markets. Machine learning algorithms are decreasingly employed to identify trends, assess threats, and make data-driven predictions, furnishing market actors with a competitive edge. As technological geography evolves, integrating artificial intelligence in fiscal decision-making becomes profitable and frequently necessary.

In this evolving period of data-driven perceptivity and technological advancements, Stock Price Prediction Using Machine Learning daisies is at the forefront, promising a more accurate, adaptive, and practical approach to anticipating market movements.

By exploring the crossroads of finance and technology, we may gain perceptivity into stock market complications and develop further effective investing ways.

Machine Learning: Revolutionizing Stock Price Prediction

With their unequaled capability to navigate vast datasets and discern intricate patterns, machine learning algorithms are a game-changer in pursuing accurate market predictions.

At the core of this metamorphosis is the capacity of machine learning models to learn from literal stock data.

By assaying once market trends, trading volumes, and other applicable pointers, these algorithms gain precious perceptivity that traditional styles frequently fail to capture. The keyword here’s rigidity, as these models recognize correlations and seamlessly acclimate to the dynamic nature of changing market conditions.

Unlike conventional approaches, machine learning algorithms don’t calculate solely on predefined rules or mortal suspicion. Instead, they autonomously upgrade their models grounded on new information and evolving patterns in the data.

This rigidity enables them to give predictions and perceptivity that transcend the limitations of traditional logical styles.

Foundational to machine learning algorithms are historical stock data. These models ingest and reuse vast quantities of literal information, relating subtle connections between variables that impact stock prices.

The result is a predictive capability extending beyond the compass of mortal analysis, unveiling retired patterns and trends within the data.

The rigidity of machine learning models to changing market conditions is a crucial differentiator. Markets are innately dynamic, told by factors similar to profitable pointers, geopolitical events, and investor sentiment.

Traditional styles frequently need help to keep pace with these oscillations. Still, machine learning algorithms excel at fetching and incorporating new patterns, ensuring their predictions remain applicable in the face of evolving market dynamics.

One of the fundamental strengths of machine learning in stock price forecasting is its capability to fete correlations that may need to be more incontinently apparent to mortal analysts. The complexity of fiscal markets requires a nuanced understanding of interdependencies between colorful factors. Machine learning algorithms excel at uncovering these intricate connections, allowing for a more comprehensive and accurate assessment of stock price movements.

“Stock Price Prediction Using Machine Learning” transcends the limitations of conventional styles by employing advanced algorithms’ rigidity and logical prowess. As fiscal markets continue to evolve, the part of machine learning in furnishing accurate predictions and precious perceptivity becomes increasingly necessary.

Investors and analysts navigating the complications of the stock market are now empowered with a tool that not only sifts through massive datasets but also discerns patterns that escape traditional approaches, marking a paradigm shift in the geography of stock price prediction.

Types of Machine Learning Models

In “Stock Price Prediction Using Machine Learning,” the selection of machine learning models significantly influences the perceptivity and solidity of predictions. Understanding the various types of models is essential for investors and analysts seeking to harness the power of machine learning.

Regression Models

The regression model is one primary type of machine learning model for stock price prediction. Linear regression, in particular, is extensively employed in finance. To predict unborn stock prices, these models establish connections between colorful input variables, similar to literal stock prices, trading volumes, and profitable pointers.

Regression models give a straightforward yet practical approach to understanding how changes in one variable impact the target variable, which, in this environment, is the stock price.

Time Series Analysis

Time series analysis is another pivotal element of machine learning in stock price prediction. Fiscal data is innately successional, with values recorded over time. Time series models concentrate on landing patterns within this chronological data.

They’re well-suited for recognizing trends, seasonality, and cyclic patterns, furnishing precious perceptivity into the temporal dynamics of stock prices. Approaches like autoregressive integrated moving average( ARIMA) and seasonal decomposition of time series( STL) are generally employed in this sphere.

Neural Networks

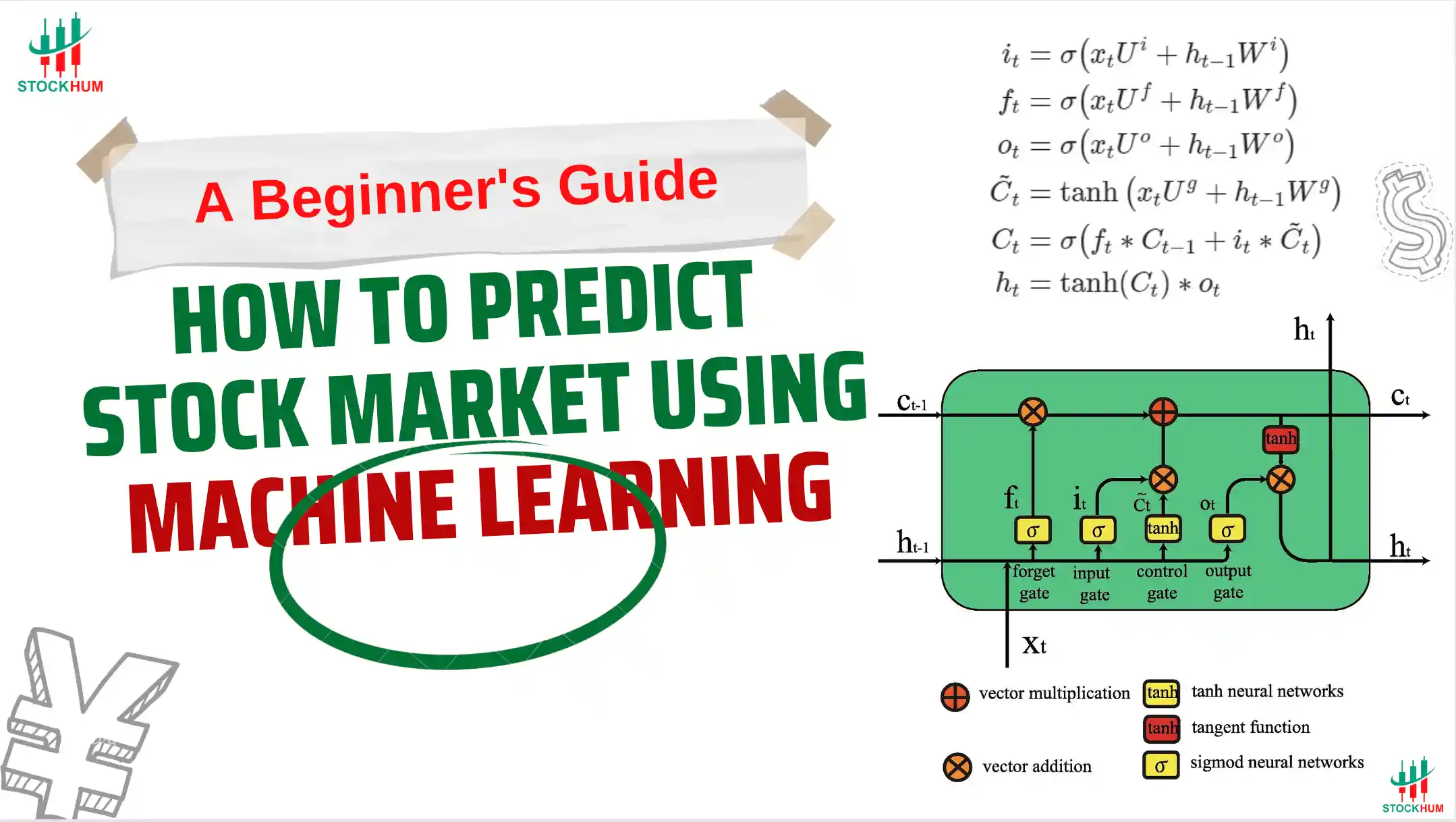

Neural networks, modeled after the structure of the mortal brain, serve as pivotal tools in machine learning. In stock price prediction, artificial neural networks (ANNs) and, more specifically, deep learning models like Long Short-Term Memory (LSTM) networks have gained elevation.

Neural networks handle complex connections in data, making them well-suited for landing intricate patterns in stock price movements. Their capability to reuse vast amounts of information and recognize non-linear dependences makes them a potent choice for sophisticated analyses.

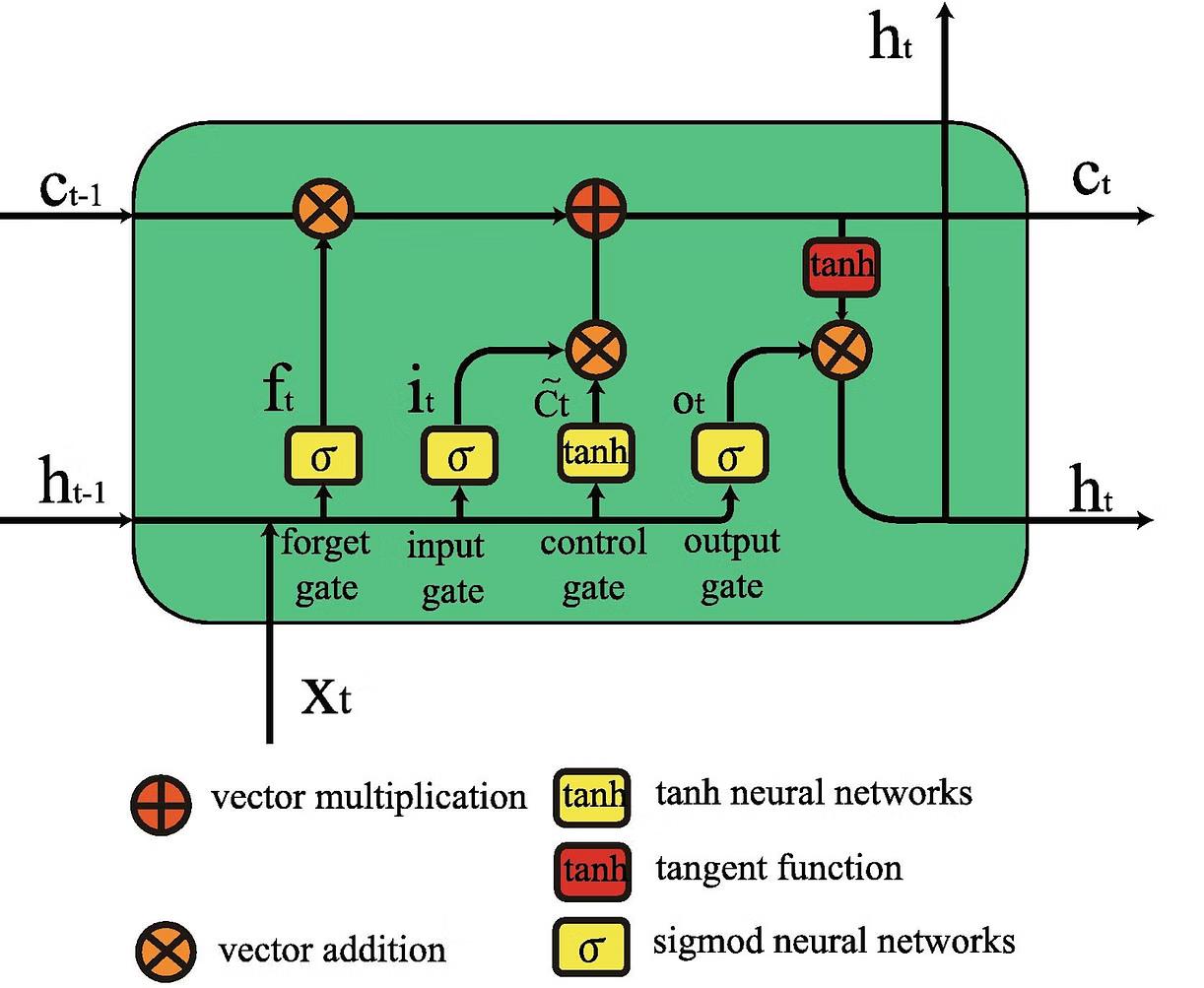

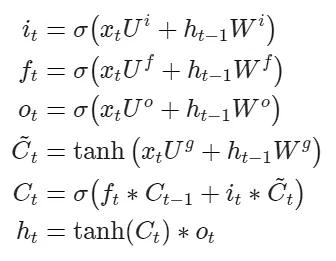

The standard LSTM ( Long Short-Term Memory) cell consists of three pivotal gates: input, output, and forget. These gates autonomously learn their weights, impacting the decision on retaining or discarding information from the current data sample.

This architectural design represents a notable improvement over earlier RNN models, allowing further effective operation of information retention and forgetting grounded on contextual applicability.

The equations below illustrate the calculation for each timestamp( t) in an LSTM cell. In these equations,’ i,” f,’ and’ o’ denote the input, forget, and output gates independently. The cell state’ C’ retains the learned information, and the output’ h’ is deduced from this cell state. The calculations consider the information learned from the former timestamp( t- 1).

Ensemble Methods

Ensemble styles combine predictions from multiple machine learning models to enhance overall delicacy. Random Forests and grade Boosting Machines (GBM) exemplify ensemble styles generally employed in stock price prediction. By adding up the predictions of different models, ensemble styles alleviate the threat of overfitting and ameliorate robustness, performing in further dependable predictions.

Support Vector Machines( SVM)

Support Vector Machines prove effective for category and regression tasks, especially for datasets with intricate patterns and multiple variables. In stock price prediction, SVMs dissect literal data and aim to find a hyperplane that stylishly separates data points, easing the prediction of unborn stock prices.

Clustering Models

Clustering models, similar to k-means clustering, are precious for relating essential groupings within stock price data. These models help uncover distinct market administrations or trends by grouping analogous data points.

Understanding the underpinning clusters within literal data allows for further nuanced analysis of stock price movements, abetting the development of targeted prophetic models.

The different array of machine learning models available for “Stock Price Prediction Using Machine Learning” underscores the inflexibility and rigidity of these tools. Each model type has its strengths and limitations, and the choice depends on factors similar to the nature of the data, the asked position of interpretability, and the specific objects of the analysis.

As fiscal markets continue to evolve, staying abreast of the recent advancements in machine learning models is essential for those seeking to make informed opinions in the complex world of stock trading.

Ensemble Methods

Ensemble styles combine predictions from multiple machine learning models to enhance overall delicacy. Random Forests and grade Boosting Machines (GBM) exemplify ensemble styles generally employed in stock price prediction. By adding up the predictions of different models, ensemble styles alleviate the threat of overfitting and ameliorate robustness, performing in further dependable predictions.

Support Vector Machines( SVM)

Support Vector Machines prove effective for category and regression tasks, especially for datasets with intricate patterns and multiple variables. In stock price prediction, SVMs dissect literal data and aim to find a hyperplane that stylishly separates data points, easing the prediction of unborn stock prices.

Clustering Models

Clustering models, similar to k-means clustering, are precious for relating essential groupings within stock price data. These models help uncover distinct market administrations or trends by grouping analogous data points.

Understanding the underpinning clusters within literal data allows for further nuanced analysis of stock price movements, abetting the development of targeted prophetic models.

The different array of machine learning models available for “Stock Price Prediction Using Machine Learning” underscores the inflexibility and rigidity of these tools. Each model type has its strengths and limitations, and the choice depends on factors similar to the nature of the data, the asked position of interpretability, and the specific objects of the analysis.

As fiscal markets continue to evolve, staying abreast of the recent advancements in machine learning models is essential for those seeking to make informed opinions in the complex world of stock trading.

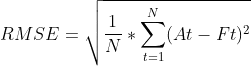

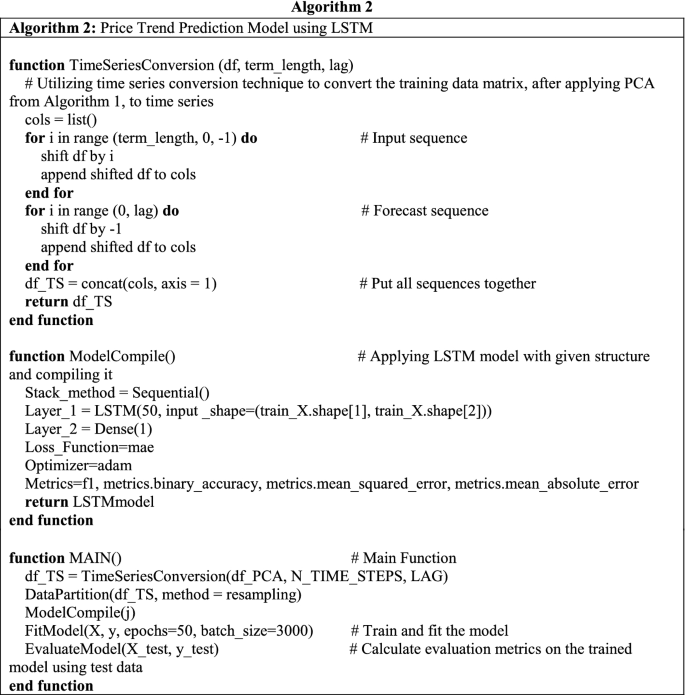

Again, MAPE focuses on the error relative to the actual value, assessing how comparatively distant the predicted values are from the factual variety rather than solely considering the absolute difference.

This metric is precious in maintaining error ranges, especially when dealing with large or small values. For illustration, when working with values in the range of 10e6, RMSE might display disproportionate bulks, while MAPE helps to constrain crimes within a more standardized range.

Use of Technology for Predicting Stock Price

Creating machine learning-driven operations for prophetic stock price analytics involves handling expansive data collection, processing, storehouse, and developing ML models and end-user operations. Below are crucial technologies pivotal for similar systems.

| Aspect | Technologies |

| Programming Language | Python (preferred), Java, R |

| Data Storage & Processing | MySQL, PostgreSQL, Apache Cassandra, Cloud Infrastructure |

| Machine Learning Libraries | Pandas, TensorFlow, Keras, PyTorch |

Programming Language:

Python is the primary language for AI and ML systems due to its expansive configurations and libraries. Also, Java and R are employed in ML systems.

Data Storage & Processing:

A robust structure, on-ground or in the cloud, is essential for storing and analyzing large datasets. Popular choices include MySQL, PostgreSQL, Apache Cassandra, and using cloud structure.

Machine Learning Libraries:

Masterminds calculate pre-built algorithms and tools from ML libraries to expedite ML model development. Notable libraries include Pandas, TensorFlow, Keras, and PyTorch, as stressed by the StackOverflow check.

This streamlined set of technologies facilitates the development of effective and scalable machine learning operations for predictive stock price analytics.

How to Predict Stock Market Using Machine Learning: Step-by-Step Guidelines

Embarking on a machine-learning expedition for stock market prediction requires a systematic approach. From problem description to model deployment, each step plays a pivotal part. Let’s explore this process with clarity and effectiveness.

| Step | Description |

| 1. Define a Problem | Easily articulate the aims and necessity for machine learning. Formulate precise questions, define data types, and establish the ultimate design objects. Whether erecting a trading platform or refining prophetic models, clarity is crucial. |

2. Gather Data Source: | Applicable data for training and testing ML models. Use APIs or datasets from Yahoo Finance, Google Finance, Kaggle, or Alpha Vantage. Data quality and volume significantly impact prediction delicacy. |

| 3. Prepare a Dataset | Data scientists ensure dataset quality through review, cleaning, metamorphosis, and splitting for training and testing purposes. Proper data preparation optimizes model performance. |

4. Choose/ Produce a Model | Decide whether to make a custom model or use pre-built bones. Resources like TensorFlow Hub, AWS Marketplace, PyTorch Hub, or Hugging Face offer pre-trained models that can be acclimated to specific conditions. |

| 5. Train a Model | To Influence cloud servers (e.g., AWS, Google Cloud, Azure) for practical ML model training. Choose between supervised and unsupervised learning, which is frequently preferred for stock predictions due to its delicacy. |

| 6. Test and Acclimate a Model | Evaluate model delicacy using a separate test dataset. Acclimate parameters, including training sets and learning rates, to enhance delicacy if demanded. |

| 7. Form Predictions | Emplace the trained model for actual-world operations, similar to trading. Consider developing user-friendly software for imaging prognostications, enhancing the stoner experience. |

This structured approach ensures a comprehensive and practical application of machine learning for stock market prediction, combining sphere expertise, data analysis, and model optimization.

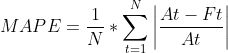

Predictive Solution Fig

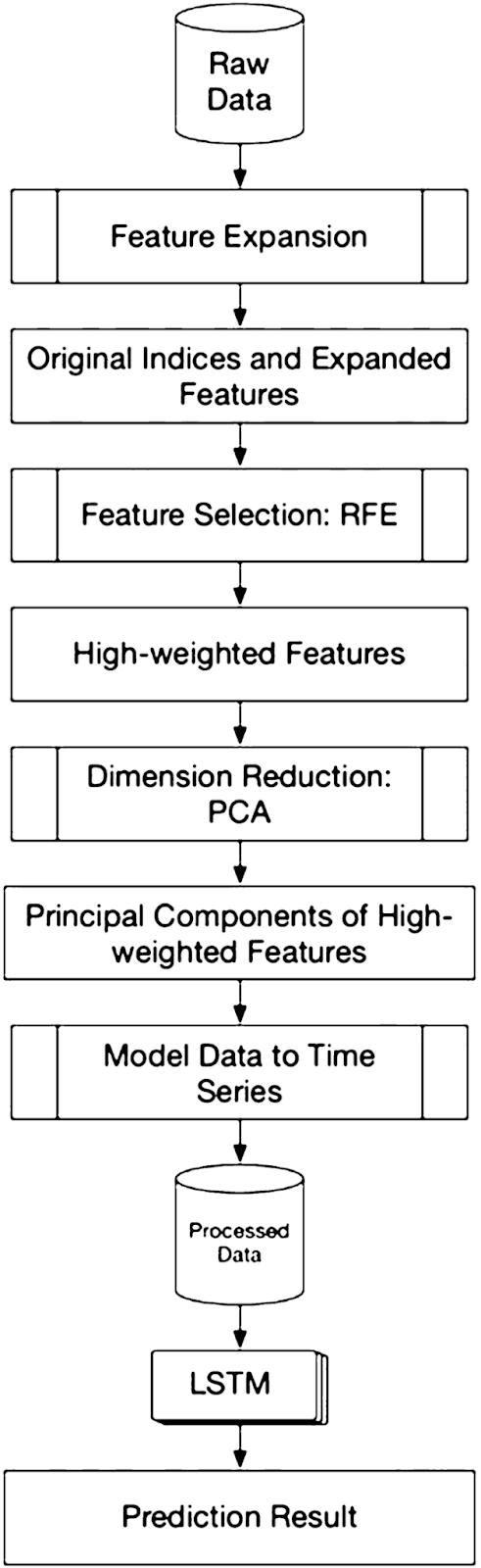

Algorithm 1: Overview Short-term Stock Price Trend Prediction

Objective

Predict short-term stock market price trends using point engineering methods, including feature extraction ( FE), recursive point elimination ( RFE), and principal component analysis ( PCA).

Principal Component Analysis( PCA) Fitness Check

The top factors’ Explanation Power( ACR) is calculated using the PCA system. Still, PCA is supposedly infelicitous due to implicit loss of original information If ACR falls below 85. Data standardization is pivotal before PCA to address perceptivity to data proportions.

Array Description (fe_array)

Defined grounded in Table 2, rows correspond to features, and columns ( 0, 1, 2, 3) independently indicate normalization, polarization, maximum–min scaling, and change chance styles. Values in the array( 0 or 1) signify whether a point requires a separate extension system.

Algorithm Steps

Follow the rules to settle the fe_array, where 0 implies no need for expansion, and 1 signifies the operation of the corresponding extension system. Final Data Preprocessing Algorithm Utilizes Recursive Feature Elimination( RFE) and PCA for effective feature selection and dimensionality reduction.

This summary outlines the crucial way of Algorithm 1, emphasizing the significance of ACR evaluation, standardization, and the dynamic selection of extension styles during feature engineering.

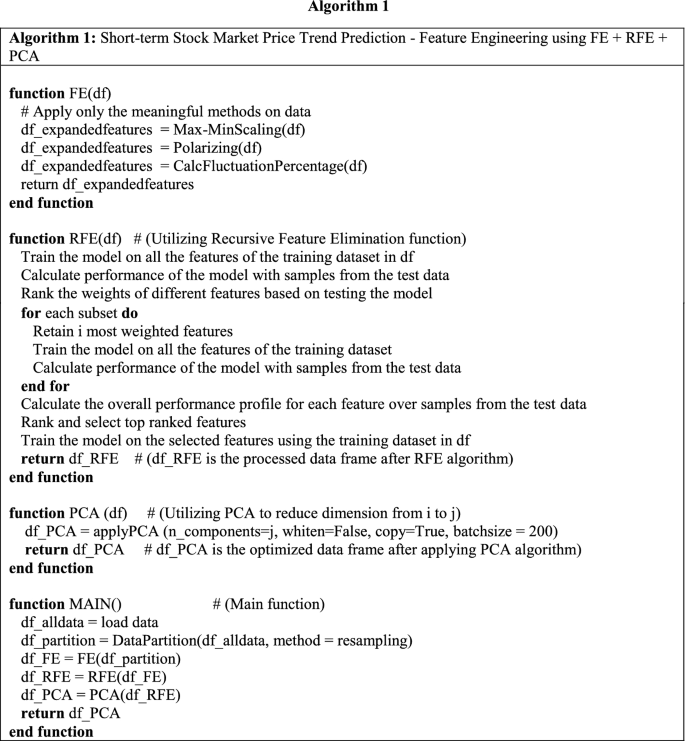

Algorithm 2: LSTM Price Trend Prediction Model

Principal element Extraction:

- Gain a scale-reduced matrix through top-element extraction.

- Convert compelling features into principal factors for model training.

LSTM Model Design

- Specifically, use the LSTM ( Long Short-Term Memory) model for predicting stock prices.

- Apply a conversion procedure for the stock price dataset.

Time Series Conversion (Time Series Conversion)

- Shift the top factors matrix grounded on the number of time ways ( term length).

- Induce a reused dataset comprising input and prediction sequences.

- Parameters LAG = 1( diurnal pattern discovery), N_TIME_STEPS varies from 1 to 10 trading days.

Functions

Data Partition(): Standard data partitioning step

- Fit Model(): Regular model fitting step.

- Estimate Model(): Standard model evaluation step.

- Model Compile(): Describes NN structure, optimizer choice, and other parameters.

Model Parameters

- NN structure, optimizer choice, and related parameters are specified in the Model Compile() function.

This simplified overview highlights the core way of Algorithm 2, emphasizing using LSTM for stock price prediction and converting top factors into a time series for practical model training.

Challenges and Considerations in Stock Price Prediction Models

While promising, predicting stock prices using machine learning has challenges and considerations. Navigating these complications is pivotal for understanding the models’ limitations and maximizing their effectiveness.

1. Challenges and Implicit Impulses

Machine learning models can be susceptible to impulses present in literal data, potentially leading to disposed predictions. Unlooked-for market events or anomalies not captured in the training data may pose challenges.

It is essential to admit these limitations and continuously upgrade models to enhance their rigidity to evolving market conditions.

2. Staying Informed about Market Dynamics

While machine learning models excel at processing data, they may need help interpreting the broader market dynamics environment. Similar to geopolitical events, nonsupervisory changes, or global profitable shifts, external factors can significantly impact stock prices.

Mortal suspicion and market experience remain invaluable in supplementing the models, emphasizing the need for a holistic approach that combines algorithmic predictions with a nuanced understanding of fiscal geography.

3. Nonstop Model Monitoring and Updates

The fiscal geography is dynamic, and market conditions can change fleetly. It’s imperative to institute a system of nonstop monitoring for machine learning models.

Regularly streamlining the models grounded on new data, conforming parameters, and incorporating the rearmost market perceptivity ensures that predictions remain applicable and accurate.

Failing to acclimate to changing conditions can render the most sophisticated models obsolete and compromise the trustability of their predictions.

While stock price prediction using machine learning holds immense eventuality, admitting and addressing the challenges and considerations is critical.

By understanding the implicit impulses, staying informed about market dynamics, and enforcing non-stop monitoring and updates, stakeholders can harness the power of machine learning to make further informed investment opinions in an ever-evolving fiscal geography.

Conclusion

In stock market predictions, the integration of machine learning marks a vital moment, offering a transformative path forward. As we unravel the complications of How to Predict Stock Market Using Machine Learning?

it becomes apparent that this technology holds an unequaled oath in enhancing predicting delicacy and abetting decision-making in fiscal markets.

The challenges and considerations, from implicit impulses in models to the necessity of staying attuned to market dynamics, emphasize the significance of espousing a holistic approach.

Admitting the limitations of machine learning models while using their strengths empowers investors, analysts, and dealers to navigate the dynamic geography of stock markets with less confidence.

The nonstop monitoring and updates for machine learning models ensure rigidity to ever-changing market conditions, supporting their applicability and trustability. This iterative refinement process ensures that these prophetic tools evolve alongside the complications of the fiscal world.

How to Predict Stock Market Using Machine Learning emerges as a dynamic and necessary tool for those seeking to decrypt the future of markets. As technology and finance meet, this innovative approach is a testament to the ongoing elaboration of investment strategies, furnishing a data-driven compass to guide us through future misgivings and openings.

FAQs [Frequently Asked Questions]

Which Algorithm is Used for Stock Price Prediction?

Various algorithms are engaged for stock price prediction, with popular choices including LSTM ( Long Short-Term Memory) for time-series analysis and point engineering approaches similar to PCA and RFE.

Which AI is Best for Predicting Stock Prices?

AI-driven high-frequency trading( HFT) is the unrivaled result for precise stock price prediction. These algorithms execute trades in milliseconds, enabling astounding capitalization on minute price differences for investors and financial institutions.

Which Machine Learning Technique is Best for Stock Prediction?

From long short-term memory ( LSTM) and intermittent neural networks ( RNN) to graph neural networks, deep learning algorithms constantly showcase enriched stock prediction capabilities compared to traditional machine learning approaches.

Is AI Good at Prediction?

Artificial Intelligence( AI) is sparking a revolution in numerical weather prediction.

Trained AI systems running on affordable desktop computers can now produce 10-day predictions within beats, competing with or surpassing the delicacy of the stylish traditional models.

Reference

- Biswal, A. (2023, October 11). Stock price prediction using machine learning: An easy guide: Simplilearn. Simplilearn.com. https://www.simplilearn.com/tutorials/machine-learning-tutorial/stock-price-prediction-using-machine-learning

- Master guide on Machine Learning for Stock Prediction Implementation. CodeIT. (n.d.). https://codeit.us/blog/machine-learning-for-stock-prediction

- Raval, | BY Param. (n.d.). Stock price prediction using machine learning with source code. ProjectPro. https://www.projectpro.io/article/stock-price-prediction-using-machine-learning-project/571

- Shen, J., & Shafiq, M. O. (2020, August 28). Short-term stock market price trend prediction using a comprehensive deep learning system – journal of big data. SpringerOpen. https://journalofbigdata.springeropen.com/articles/10.1186/s40537-020-00333-6

Shinde, S. (2023, September 28). The top 5 most common machine learning techniques used in stock prediction. Emeritus India. https://emeritus.org/in/learn/stock-price-prediction-using-machine-learning/