In this Article

In the ever-changing realm of fiscal markets, the prospect of a US stock market crash prediction looms as a matter of significant concern and enterprise. As investors seek to anticipate and navigate the intricate dynamics that drive market movements, the coming five years pose a fascinating geography.

This composition aims to exfoliate light on the factors contributing to the high sense of query girding the US stock market crash predictions for the next 5 years and the academic predictions that have captured the attention of fiscal experts.

The convergence of global events, profitable pointers, and geopolitical pressures has set the stage for a potentially tumultuous period in the fiscal markets. Experts are nearly checking colorful criteria, ranging from profitable growth and affectation rates to commercial earnings and financial policy opinions, to formulate informed predictions about the market’s line.

This article will explore US stock market crash predictions for the next 5 years. Also, we will discuss crucial pointers and expert perceptivity that contribute to the ongoing converse about a possible stock market downturn. While prognostications innately carry an element of the query, understanding the factors at play can empower investors to form informed opinions and concoct strategies to rainfall implicit market storms in the times ahead.

Historical Context of US Stock Market Crash Prediction For the Next 5 Years

While it’s impossible to predict future stock market crashes with certainty, examining historical surroundings can give perceptivity to the factors that have historically contributed to market downturns. Here, considering historical patterns, we explore crucial events and trends that may impact the US stock market crash predictions for the next 5 years.

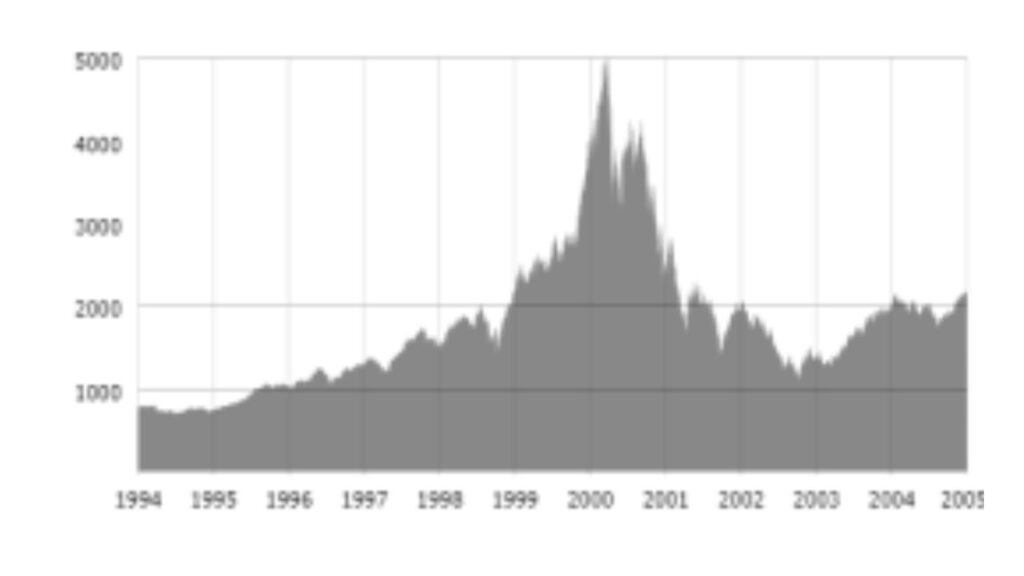

1. The Dot-Com Bubble( 2000)

In the late 1990s, the stock market endured a significant smash, particularly in the technology sector. Still, this vibrance led to exaggerated stock prices, especially for numerous internet-grounded companies.

Following the burst of the dot-com bubble in 2000, investors faced broad losses as stock values declined. Judges’ moments draw parallels between the dot-com bubble and the current enthusiasm around certain tech stocks, raising enterprises about the eventuality of another academic bubble.

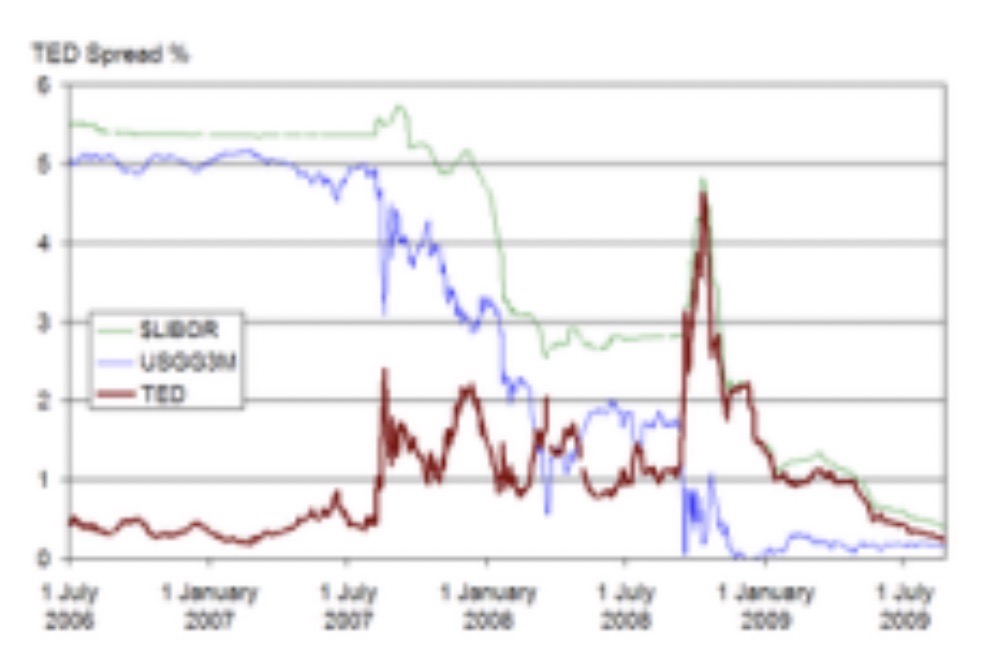

2. Global Financial Crisis (2007- 2008)

The most recent major market crash passed during the global fiscal extremity, touched off by the subprime mortgage market’s collapse. Fiscal institutions faced severe stress, and the extreme had a slinging effect on global markets. Moment, enterprises about systemic pitfalls and the interconnectedness of fiscal markets persist. Judges nearly cover profitable pointers to identify signs of an analogous extremity brewing.

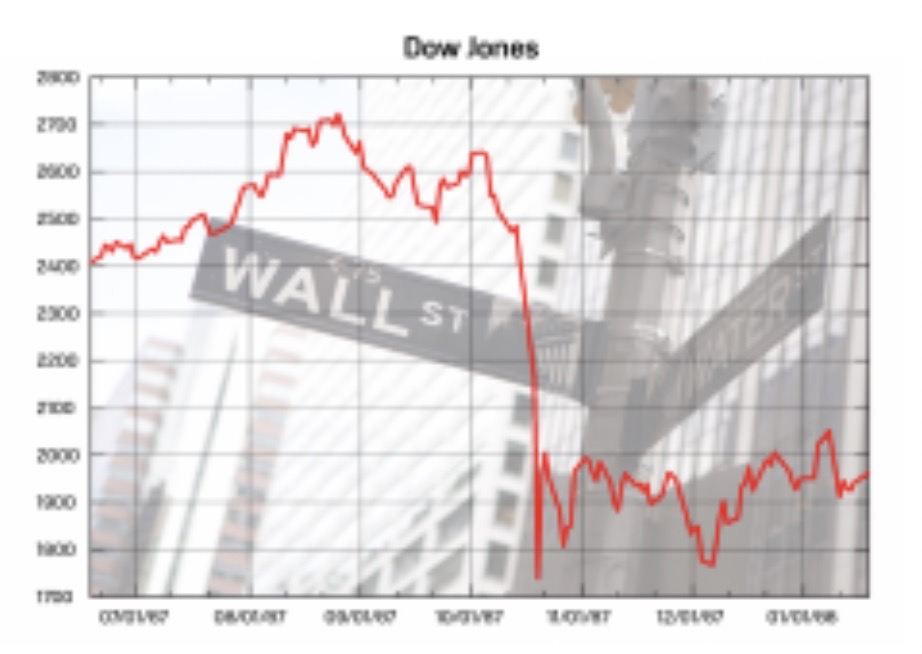

3. Black Monday (1987)

The shameful stock market crash of 1987, dubbed Black Monday, witnessed the Dow Jones Industrial Average lowering by over 22 in a single day. While the causes of this crash were complex, including overvaluation and automated trading, it serves as a memorial of the eventuality of rapid-fire and severe market declines. At the moment, enterprises about market liquidity and the role of algorithmic trading are motifs of discussion among analysts.

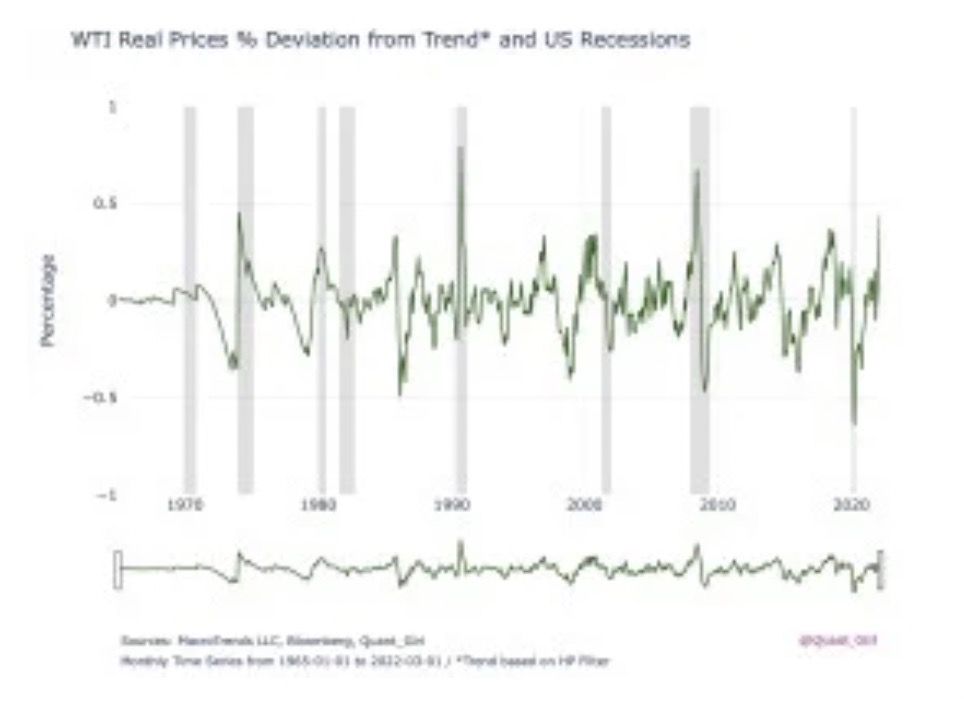

4. Oil Price Shocks and Recessions

Historically, dislocations in the oil painting request have frequently been identified with profitable downturns. Events similar to the oil painting prescription in the 1970s and the oil painting price collapse in the 2010s significantly impacted global farming and fiscal markets. Judges keep a close eye on geopolitical events, similar to conflicts in oil painting-producing regions, as they can impact energy prices and, accordingly, market stability.

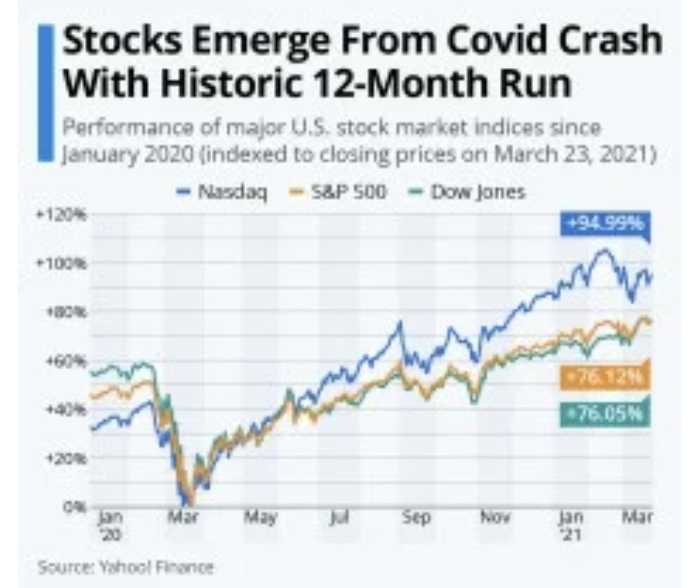

5. Pandemics and Health Crises

The COVID-19 epidemic in 2020 had an unknown impact on the global frugality and fiscal markets. While the epidemic was unlooked-for, health heads and other unlooked-for events can profoundly affect investor sentiment and profitable exertion. Analysts are conservative about implicit unborn health crises and their implications for the markets.

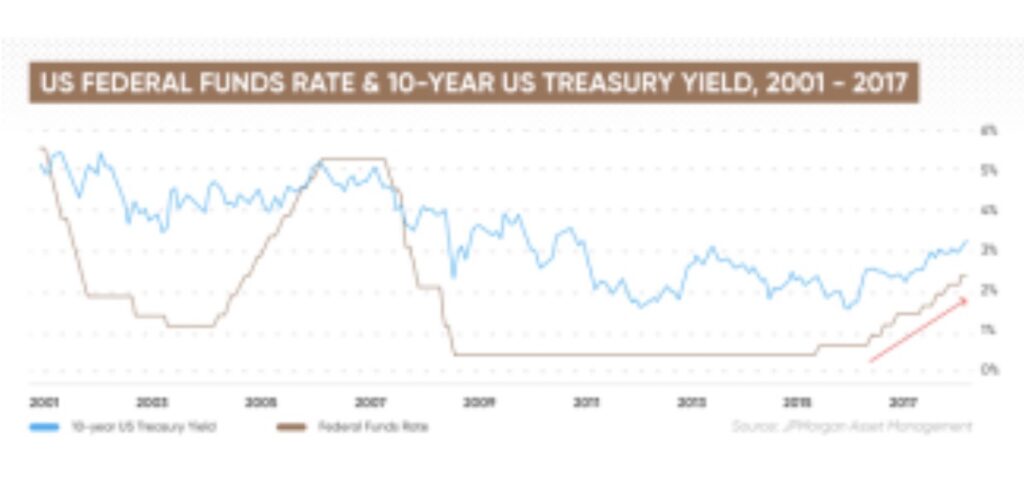

6. Interest Rate and Monetary Policy Shifts

Significant crashes from interest rate changes and fiscal policy endangering the stock market to the Volcker interest rate hikes in the early 1980s; historical cases illustrate how policy shifts can prompt market acclimations. Analysts assess the implicit consequences for equity markets with the Federal Reserve nearly covering affectation and consequently conforming interest rates.

7. Political and Trade Developments

Political events and trade pressures have historically told markets. For example, the retirement of the US-China-China trade has volatility. Political queries, significantly during election cycles, can impact investor confidence.

Analysts nearly follow geopolitical developments and trade accommodations for implicit market allegations.

As we dissect the previous environment of US stock market crashes, it becomes apparent that colorful factors, both domestic and global, have played places in shaping market issues. While history doesn’t repeat itself, patterns and themes can inform our understanding of implicit pitfalls and challenges.

Looking ahead to the coming five years, investors and judges must remain watchful, considering a range of factors, including profitable pointers, geopolitical events, and the adaptability of fiscal institutions.

While predicting specific market movements remains fugitive, a comprehensive understanding of literal surrounds can help market actors navigate the misgivings essential in fiscal markets.

Current Economic Landscape of the US Stock Market

As of the most recent available data, the United States is navigating a complex, profitable geography shaped by the fate of the COVID-19 epidemic. Then is an analysis of crucial factors impacting the current profitable environment and their implicit impact on the US stock market

8. Recovery from the COVID-19 Epidemic

The US frugality is in the process of recovering from the severe dislocations caused by the COVID-19 epidemic. Vaccination efforts have been underway, leading to a gradual return to normality.

This recovery has been reflected in colorful profitable pointers, including GDP growth, employment rates, and commercial earnings.

9. Monetary Policy Response

The Federal Reserve has been visionary in enforcing financial programs to support profitable recovery. Maintaining historically low- interest rates has been a crucial strategy to navigate profitable challenges.

Low interest rates incentivize borrowing and spending, boosting consumer exertion and business investment. Also, the Federal Reserve has engaged in bond-purchasing programs to inject liquidity into the fiscal system.

10. Unemployment Rates

Unemployment rates have shown enhancement, reflecting an answer in profitable exertion. Still, it’s pivotal to note that the pace of recovery in the labor market may vary across different sectors and regions. Patient differences in employment could impact consumer spending patterns and overall profitable growth.

11. Commercial Earning

Commercial earnings have endured an answer as businesses acclimatize to the post-pandemic geography. Numerous companies have demonstrated adaptability and agility in responding to challenges, contributing to bettered fiscal performance. Strong commercial earnings positively impact stock prices, but variations vary among sectors.

12. Inflationary Pressures

Affectation has been a significant concern in the current profitable geography. Inflationary pressures have surfaced from force chain dislocations, heightened demand for goods and services during profitable renewal, and rising commodity prices.

The Federal Reserve has conceded these enterprises and has indicated the ability to tolerate a temporary period of advanced affectation. Still, sustained affectation could prompt adaptations in financial policy, including interest rate hikes.

13. Supply Chain Disturbances

Global force chain dislocations have been a notable challenge. Issues like transportation backups, deaths of critical factors, and logistical challenges have affected the product and distribution of goods. These dislocations can lead to increased business costs, potentially impacting profit perimeters.

14. Ongoing Uncertainties

Despite positive profitable pointers, uncertainties persist. The line of the COVID-19 epidemic, the emergence of new variants, and implicit policy shifts each contribute to a terrain of unpredictability.

Investors cover these factors nearly, feting their eventuality to impact request sentiment and decision-making. Decision-making. The current profitable geography of the United States is characterized by a recovery from the COVID-19 epidemic, supported by friendly financial programs.

While positive trends are apparent, challenges like inflationary pressures, force chain dislocations, and ongoing uncertainties introduce complications that could impact the line of the US stock market in the coming times.

As conditions evolve, investors and policymakers must acclimate to the changing profitable environment and make informed opinions to navigate implicit pitfalls and subsidize on chances.

US Stock Market Crash Predictions For the Next 5 Years

Fiscal analysts and institutions regularly release predictions and analysis grounded on their assessments of market trends and profitable pointers. Admitting that these prognostications are academic and subject to change grounded on evolving circumstances is essential.

Here, we punctuate the US stock market crash prediction for the next 5 years.

Cautious Optimism:

Some analysts express conservative sanguinity, citing the ongoing profitable recovery, commercial solid earnings, and probative financial programs. They believe that while market corrections may happen, a full-bloated crash is less likely if profitable conditions remain relatively stable.

Inflationary Concerns:

Others advise of implicit pitfalls associated with inflation. However, central banks may respond with interest rate hikes, which could impact stock valuations If affectation continues to rise. Analysts advise investors to cover inflationary pointers and acclimate their portfolios consequently.

Technology and Innovation:

Analysts fastening on technological advancements punctuate the eventuality for uninterrupted growth in sectors similar to artificial intelligence, renewable energy, and biotechnology. They argue that companies driving inventions may outperform, contributing to overall market adaptability.

Geopolitical Risks:

Geopolitical pressures, trade conflicts, or unanticipated events on the global stage remain sources of concern for some analysts. They emphasize the significance of diversification and staying informed about geopolitical developments to alleviate implicit pitfalls.

Profitable Encouragement and Government Programs:

The effectiveness of government encouragement measures and the perpetration of financial programs are areas of focus for numerous analysts. Positive issues from government interventions support market stability, while mistakes could have adverse goods.

Predicting the future of the US stock market is a complex and grueling task, as it involves navigating many profitable, political, and social factors. While literal environment and expert analysis give precious perceptivity, the query remains essential to fiscal markets.

Investors are always encouraged to stay informed, diversify their portfolios, and regularly reassess their investment strategies grounded on evolving market conditions. Also, seeking advice from fiscal professionals and conducting thorough exploration can help individuals make informed opinions aligned with their fiscal pretensions and threat forbearance.

Eventually, the US stock market’s line over the coming five times will be shaped by the interplay of colorful factors, and staying watchful in covering these dynamics will be pivotal for investors looking to navigate the ever-changing geography of fiscal markets. These factors will help you understand US stock market predictions for the next 5 years.

NASDAQ’s Stock Market Crash Predictions in 2024

As investors approach the end of a successful year on the stock market, characterized by an18 increase in the S&P 500 through November 17, questions arise about the prospects for 2024. The time 2023 has seen the stock market defy prospects, rallying amidst interest rate hikes, patient affectation, and geopolitical pressures.

As we look ahead, it becomes imperative to anatomize the macroeconomic enterprises that persist and dissect the factors that might impact the stock market’s line in 2024.

Key economic Indicator:

| Indicator | Current Status Outlook |

| S&P 500 Performance (YTD) | +18% admiring, despite challenges |

| Unemployment Rate | <4% Low for 16 successive months |

| GDP Growth ( Q3 2023 ) | 4.9% well profitable growth |

| US Fund Rate Predictions (2024) | Expected to fall by 50 Indicates minor rates for basis points longer. |

Factors Impacting Market Outlook

1. Interest Rate Outlook:

Current Scenario: Elevated interest rates affecting casing, business investment, and consumer spending.

Outlook:

There is an enterprise about the possibility of interest rates dwindling in 2024, potentially furnishing a boost to the stock request. The Investor Sentiment Rally is fueled by the belief that the Fed will not increase rates further due to falling affectation and a softening frugality.

2. Tech Sector Resilience:

Current Scenario:

Big tech companies passed layoffs a time ago; and recent acceleration in deals and profit growth.

Outlook:

Continued growth in big tech; performance is pivotal for overall market stability. Influence on indicators: Tech stocks significantly impact significant indicators like the S&P 500.

3. Overall Economic Health:

Current Scenario:

Unemployment rate below 4 for 16 months; GDP growth at 4.9 in Q3 2023.

Outlook:

Baseline profitable data are encouraging, suggesting overall profitable health. Sector Variability While some sectors face challenges (e.g., real estate), the broader frugality remains solid.

In summary, despite facing challenges similar to elevated interest rates, implicit recession predictions, and signs of weakening consumer spending, a stock market crash in 2024 appears doubtful.

The anticipated downcast trend in interest rates, the adaptability of big tech companies, and the overall robust, profitable pointers contribute to a more optimistic outlook.

Investors should still admit the essential volatility of the stock market and be prepared for misgivings.

While the current line and profitable data on the ground give a sense of confidence, unlooked-for global conflicts, political crises, or black-swan events could introduce unpredictability. Navigating the stock market in 2024 will bear a measured approach, with an understanding that volatility is an essential part of the investment geography.

Stock Market Crash Predictions: (2025-2030)

Predicting stock market movements, including crashes, is largely grueling and frequently academic. Analysts use colorful pointers and models, but it’s essential to note that no system guarantees delicacy.

Then is a simplified illustration of how one might approach the analysis using literal data and some standard pointers for the NASDAQ stock indicator.

- The analysis covers the period from 2025 to 2030.

- We will consider three crucial pointers: Price-to-earnings ( P/ E) ratio, Volatility Index (VIX), and Economic Growth.

Stock Market Forecast Predictions: (2024-2032)

| Year | Price |

| 2024 | 5100 |

| 2025 | 5700 |

| 2026 | 5950 |

| 2027 | 6200 |

| 2028 | 6725 |

| 2029 | 7300 |

| 2030 | 8900 |

| 2031 | 9350 |

| 2032 | 10200 |

Read Article: US Stock Market Predictions for Next 5 Years

Conclusion:

The geography of US stock market crash predictions for the next 5 years remains a subject of enterprise and analysis, told by myriad complex factors. While literal surrounds and expert perceptivity offer precious perspectives, predicting the precise line of the market remains fugitive.

As investors reflect on the current profitable geography, 2023 has proven to be unexpectedly flexible, with the S&P 500 flaunting an emotional 18% gain despite challenges like interest rate hikes, patient affectation, and geopolitical pressures. Looking ahead to 2024, several crucial considerations could shape the market’s future. The anticipated shift in interest rates stands out as a vital factor.

Predictions suggest an implicit drop in interest rates, motioning a positive signal for the stock market. The inverse connection between interest rates and stock prices implies that a rate decline could stimulate market exertion, encouraging investors to return to equities as borrowing becomes more favorable.

Also, the adaptability and growth of big tech companies play a pivotal part in shaping market stability. The tech sector, having survived challenges like layoffs and dislocations during the epidemic, has rebounded with accelerating deals and profit growth.

As major players like Amazon, Alphabet, Microsoft, and Meta Platforms continue to contribute

significantly to the S&P 500, their performance becomes a mark of the market’s overall health. Profitable pointers further contribute to the cautiously optimistic outlook.

Despite enterprises’ fears about an implicit recession and signs of weakening consumer spending, the unemployment rate remains below 4, and GDP growth in the third quarter of 2023 stood at a robust 4.9%. These positive pointers suggest that the overall profitable foundation is solid while challenges persist in specific sectors.

In admitting the essential unpredictability of the stock market, it’s pivotal for investors to remain watchful, diversified, and informed. While the analysis points towards a more promising script, it’s imperative to fend off the volatility associated with global events, political developments, or unlooked-for heads that can impact market dynamics.

As we navigate the US stock market crash predictions for the next 5 years, investors are advised to approach the stock market with a balanced perspective, understanding that prognosticating market crashes involves essential misgivings.

Prudent decision-making, a focus on long-term pretensions, and readiness to acclimate to evolving circumstances will be essential in successfully covering the ever-changing terrain of the US stock market.

FAQs [Frequently Asked Questions]

Is the stock market going to crash in 2024?

The liability of a stock market crash in 2024 remains uncertain. While some pointers, similar to the money fund and Leading Economic Index, suggest a bearish outlook, antithetical signals from other dependable pointers predict an implicit smash. Colorful factors, including profitable conditions, financial programs, and global events, will tell the unborn line. Investors should approach 2024 cautiously, fetching the essential unpredictability of fiscal markets.

What happens if the US stock market crashes?

If the US stock market crashes, it can lead to broad profitable consequences. Investors may face significant losses, withdrawal savings could diminish, and consumer confidence might decline. Businesses may struggle with backing, potentially leading to layoffs and a profitable downturn. Governments may need to apply measures to stabilize frugality.

A market crash frequently creates a domino effect, impacting colorful sectors and individuals and institutions’ overall fiscal health.

How long would a stock market crash last?

Since 1950, the S&P 500 has experienced 12 declines of 20% or further. On average, these market crashes lasted 342 days, with an average decline of-33.38. Significantly, the posterior bull markets that followed were incredibly robust and enduring. This literal pattern underscores the cyclical nature of financial markets, with ages of decline frequently paving the way for flexible and extended ages of market growth.

Where do you put your money before the market crashes?

For short-term investors anticipating a market crash, consider safe havens like bank CDs and Treasury securities. These options offer stability and preservation of capital. However, if planning for a longer horizon, explore fixed or listed appropriations, along with listed universal life insurance products. Acclimatizing your investment strategy to your time horizon helps navigate market misgivings and aligns with your fiscal pretensions.

Reference

1. Beunk, M. (2020, December 18). The economist who predicted the dotcom crash thinks stocks are… remarkably cheap. Finimize.

https://finimize.com/content/why-the-world-famous-economist-who-predicted-the-dotcom-c rash-thinks-stocks-are-actually-remarkably-cheap

2. Collins, G. (2023, December 9). 5-Year stock market forecast: Outlook for 2024, 2025 2026 2027. Housing Forecasts & Stock Market Forecast.

https://gordcollins.com/stock-market/5-year-stock-market-prediction/

3. Duggan, W. (2023, December 1). Stock market outlook for 2024. USA Today. https://www.usatoday.com/money/blueprint/investing/stock-market-outlook-2024/

4. Mercadante, K. (2023, November 29). Biggest stock market crashes in U.S. history (and how to prepare) | time stamped. Time.

https://time.com/personal-finance/article/us-stock-market-crashes/

5. What the stock market is saying about when to expect a recession | CNN … (n.d.-a). https://edition.cnn.com/2023/07/02/business/stocks-week-ahead-recession-2024/index.ht ml

6. Will the stock market crash in 2024? 7 risk factors. (n.d.-b).

https://money.usnews.com/investing/articles/will-the-stock-market-crash-risk-factors