In this Article

Ever imagine making money like a pro in the stock market without demanding a financial advisor? Well, you are in the right place! Enter the world of investing simplicity with the scholarly advice of Warren Buffett, the fabulous investor.

In this paper, we’ll unravel the power behind Buffett’s rules, furnishing you with a roadmap to navigate the stock market without sweat. How do I invest like a pro? Warren Buffett’s rules for learning the art of stock investment without a financial advisor. The enchantress lies in the simplicity of his path, demystifying the stock market for everyone.

“How to invest in stocks like a pro without a financial advisor: Warren Buffett’s rules” serves as our compass in this world of intelligent investing. Buffett’s uncomplicated strategies will be your companion. From smelling out great companies at a bargain to the art of patient finding, we’ll explore the wisdom that has made Buffett a fiscal icon.

Consequently, if you want to grab the principles of stock market success, you should be aligned with Buffett’s principles.

Let’s anchor on this trip together to learn how to invest in stocks like a pro without a financial advisor: Warren Buffett rules!

Investment Principles and Rules of Warren Buffett

Warren Buffett’s investment principles, glorified for their simplicity and persuasiveness, boil down to two primary ways. Primarily, Buffett focuses on identifying great companies with natural valuations exceeding their market prices. This perceptiveness allows him to spot openings that others may dominate.

Secondly, once he acquires similar investments, Buffett adopts a patient approach, holding onto them long-term. This unvarying devotion to quality companies forms the foundation of his incomparable success in investing. These principles will help you comprehend how to invest in stocks like a pro without a financial advisor.

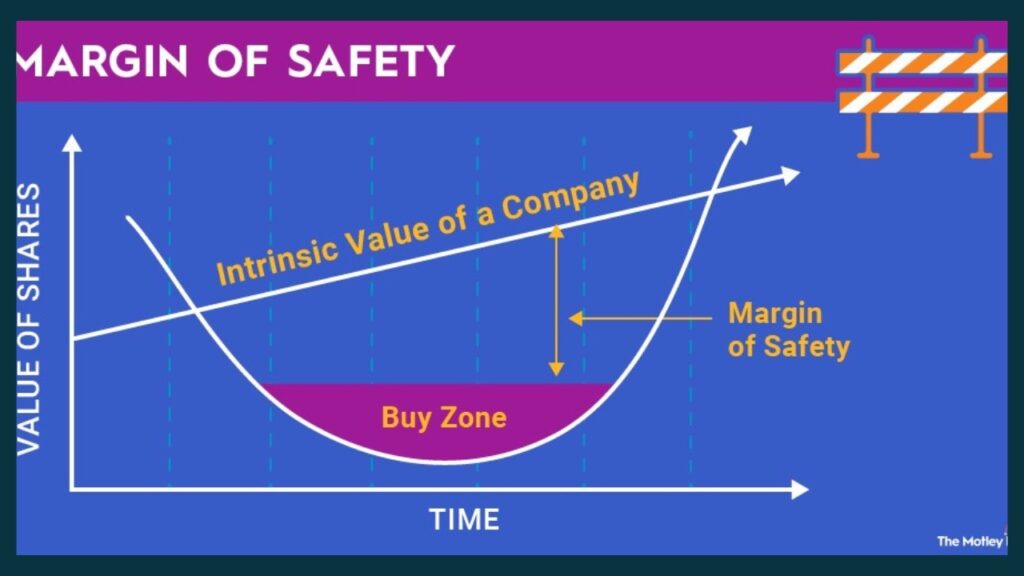

1. Securing Investments with the Margin of Safety

Warren Buffett’s investment principles center around the pivotal conception of a “margin of safety.” This principle acts as a defensive bumper for investors, assuring a position of security against implicit losses. To simplify, imagine you are buying a stock for 10 per share, but the company’s factual means are valued at 12 per share.

These two differences represent the margin of safety – a fiscal buffer that shields against a significant decline in the stock price. Buffett’s strategy revolves around paying lower than a company’s natural Value.

Example:

If Stock Price: $10

And Intrinsic Value: $12

Then Margin of Safety: $2

It showcases a simplified scenario where the stock is bought at $10, while its intrinsic Value is decided to be $12, giving a $2 margin of safety. This conception underscores Buffett’s devotedness to prudent investing, where a defensive margin enhances the flexibility of an investment portfolio.

If you acquire a stock for lower than its true worth, the natural Value acts as a safeguard, helping substantial losses indeed if the market fluctuates. Buffett emphasizes the significance of avoiding too high purchase prices, stating that paying too much can negate the positive goods of a decade of favorable business developments.

2. Quality is the priority in the World of Investments.

Warren Buffett emphasizes quality over volume in his investments. He avoids buying into floundering or low-quality businesses, indeed, if their prices drop significantly. A crucial takeaway from Buffett is that it’s better to invest in an excellent company at a reasonable price rather than a medium one at a great price.

This strategy values the importance of fastening on the strength of a company. Also, it prioritizes long-term success over short-term earnings.

3. Stand Out, Do not Follow the Investing Crowd.

Warren Buffett advises new investors to avoid unthinkingly following the cram or always going against it. In simple terms, do not buy a stock just because everyone is, and likewise, do not sell just because others are doing so. Buffett advocates for an independent approach, prompting investors to concentrate on changing value on their own rather than being affected by market trends or popular opinions.

Buffett emphasizes that the most pivotal quality for an investor is a disposition, not inescapably intellect. He suggests having a mindset that does not decide inordinate pleasure from aligning with or against the crowd. In substance, the stylish investment opinions come from a balanced and independent perspective, guided by a disposition that remains steady in the face of market oscillations.

4. Fearless Investing

Warren Buffett encourages investors not to fear market crashes and amendments. While the common thing in stock investing is to buy low and sell high, mortal nature frequently tempts us to do the contrary.

When everyone around us is making money, the instinct is to follow the action, and during market crashes, the impulse is to sell before prices drop further. Buffett experiences market downturns. He welcomes falling stock prices as they produce openings to buy quality stocks at a reduction.

To illustrate, imagine your favorite store offering a 20% reduction on everything – you wouldn’t horrify; you’d seize the chance to buy further. Also, Buffett advises investors to view market declines as openings to acquire stocks at favorable prices.

His analogy,” When it rains gold, put out the pail, not the thimble,” emphasizes the significance of being prepared to take advantage of precious openings during market turbulence.

5. Long-Term Planning for Investment Mega Hit

Warren Buffett advises investors to allow long-term returns. He suggests, “If you are not willing to enjoy a stock for ten times, do not indeed suppose about retaining it for 10 minutes.” Unlike those who concentrate on short-term earnings, Buffett selects stocks intending to hold them for an extended period. While he does sell stocks for colorful reasons, his primary approach is to view investments as long-term commitments.

However, Buffett recommends considering set-it-and-forget-it investments like an S&P 500 indicator fund, featuring the value of a patient If the idea of holding a stock for a veritably long time does not sound to you.

6. Value Investing and the Power of Compounding

Warren Buffett, the famed value investor, follows a strategy that focuses on paying low prices for investments compared to their natural values. In simple terms, it’s like buying 100 worth of a company’s stock for lower than 100.

Value investors, like Buffett, identify companies with natural values well above their market prices, anticipating that the market will ultimately honor and raise the stock price, leading to a profit for the investor.

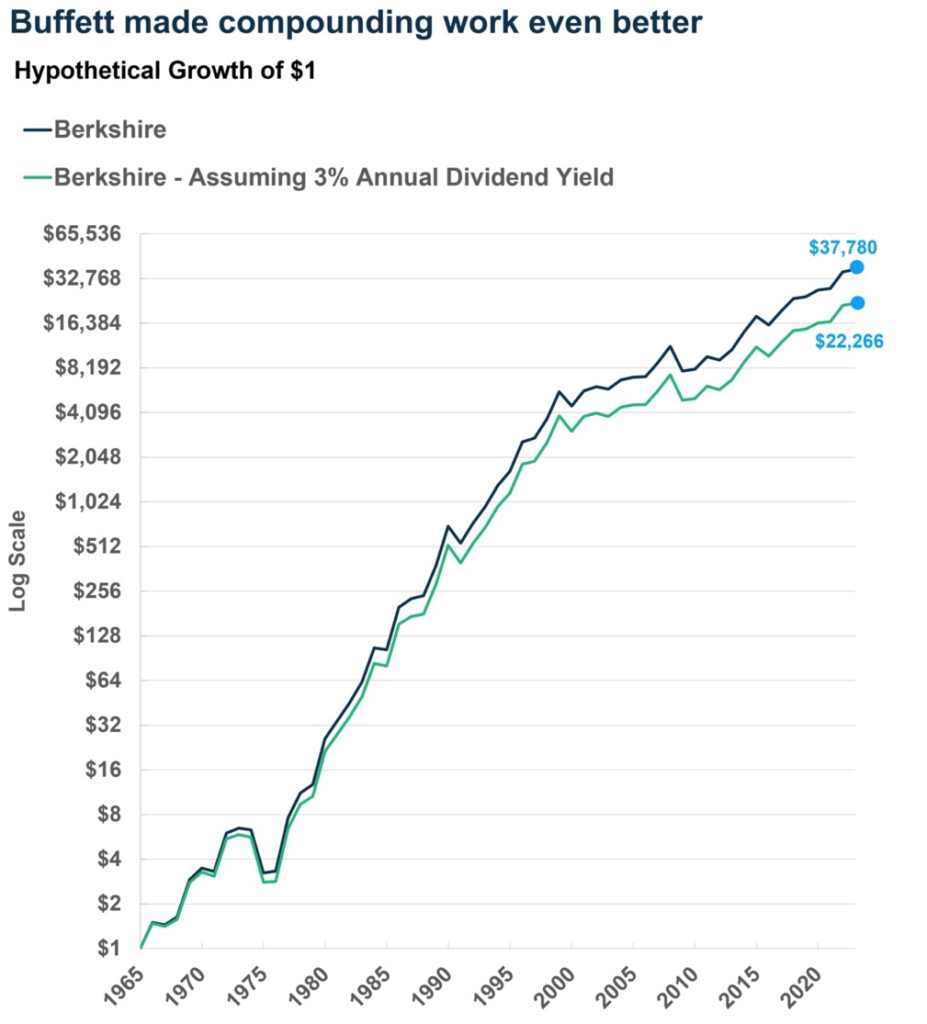

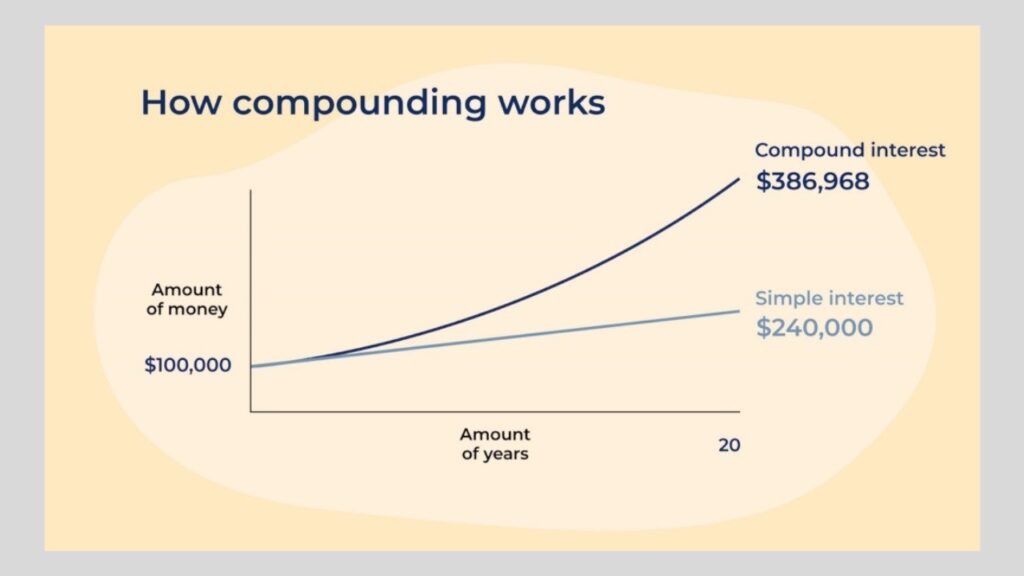

Warren Buffett’s success is embedded in understanding the magic of compounding. He leverages composite interest, reinvests tips, and continually reinvests cash inflow from Berkshire’s businesses.

This strategy has resulted in an emotional 20.1 annualized return for Berkshire since 1964, compared to 10.5 for the S&P 500. At the same time, these probabilities might not sound extraordinary originally, but the long-term effect is stunning – a total gain of for Berkshire shareholders versus 30,209 for the S&P 500.

What’s the approach to investing like a pro-without financial advisor: Warren Buffett’s Rules?

Warren Buffett is known as the key to making a lot of money. He has made a unique corner in the investment world with his smart investing approach. His unique approach is to invest in well-founded companies, not simply the common market.

He picks one that has a strong investment episode. However, Buffett’s investment approach will help you understand the process. If you are new to investing and challenge yourself to make a lot of money, it can be a fantastic way to start. Here are some approaches to investing, like Warren Buffett, that will help how to invest like a pro-without a financial advisor.

1. Value Investing :

Warren Buffett is well-known for his’ value investing’ strategy, where he buys stocks that feel underrated and sells them later when their true market value is realized. This approach relies on the idea that the market frequently reacts too explosively to feelings and media, causing some stocks to be priced lower than they should be.

Value investing necessitates a position of market and company knowledge broadly beyond that of utmost investors. It involves complex computations, considering factors like a company’s cash inflow, gains, profit, brand, business model, target market, and demand to identify underrated stocks.

To succeed in value investing, one needs substantial market and business knowledge, surpassing what casual investors generally retain. It’s about relating stocks with retired eventuality.

A successful value investor demands a deep understanding of market dynamics and amenability to dig into the complications of a company’s fiscal health. Warren Buffett’s rules for value investing are embedded in this comprehensive analysis, emphasizing the significance of long-term vision and tolerance.

For those eager to fill into this strategy, recommended readings include Benjamin Graham’s

“The Intelligent Investor” and Warren Buffett’s “The Essays of Warren Buffett: Lessons for Corporate America” offer precious perceptivity into the principles and practices of successful value investing.

2. Invest in Businesses that you’re Blossom with.

Invest in businesses that you know and understand thoroughly. This approach, a crucial principle of Buffett, involves putting your money into diligence and businesses that you know about.

Whether it’s a business you run or an assistant you are well-acquainted with, this familiarity helps in assessing the possible success of a company. Understanding the companies will teach you how to invest in stocks without a financial advisor.

While having your own business provides a unique advantage, indeed, without that, it’s pivotal to borrow a disciplined and fact-grounded approach. Avoid counting solely on instincts or enterprise; concentrate on a systematic evaluation.

Confidence in a company’s values and a strong fiscal track record are vital. Given the essential pitfalls in any investment and considering the significant capital involved, thorough exploration is crucial.

Buffett advises caution, especially with startups heavily reliant on funding from other investors. This warning is pivotal to steer clear of implicit bubbles. In substance, the principle emphasizes making informed and thoughtful opinions in the investment process.

3. Invest in Companies with Competitive Advantage.

When investing, concentrate on companies that have a competitive edge over others. This advantage, frequently called a” competitive moat,” sets them apart and helps them perform better in the market. Look for companies that have distinct advantages over their challengers, similar to cutting-edge technology, well-known brands, or personal patents.

Selecting companies with a competitive advantage can be a wise approach for long-term success in the stock market. This advantage goes beyond just the product or service; it’s like a special point that is hard for other companies to copy. It will help you comprehend how to invest in stocks without a financial advisor.

Imagine it as a unique selling point( USP) that gives a company a significant edge that could be effects like patented products, special processes, or tools that make their operations better than others.

Take Google as an illustration – it started as just another search machine but came to be smart because of its unique algorithms. Spotting these kinds of companies is a bit tricky but worthwhile.

To find businesses with a strong competitive moat, you need to do a lot of exploration and understand the assiduity well. Assaying challengers can help you find companies that stand out regarding fiscal success, having a popular product, unique technology, intellectual property, or a strong brand.

4. Invest in Businesses that have Suitable Management.

The quality of a company’s operation team is pivotal to take into account when investing. Warren Buffett, a prosperous investor, emphasizes this principle. A good management team aligns the interests of shareholders with the interests of the business.

You can assess a company’s operation by looking at how it treats shareholders, especially through tips and buybacks.

A company with a harmonious history of tip growth is generally a positive sign. Also, check how workers feel about working for the company. Happy staff frequently contribute to a company’s success and attract top gifts. On the other hand, unhappy workplaces may lose professed individualities and intellectual capital, impacting long-term prospects.

Still, consider how the company treats its staff, as it reflects on its values If ethical investing matters to you. In essence, investing in companies with a strong and ethical operation team can contribute to long-term success.

5. Invest in Long-Term for a Successful Future

Warren Buffett, a fabulous investor, suggests a patient and long-term approach to investing. Rather than chasing short-term trends, concentrate on solid companies with eventuality for success over a prolonged period. This strategy is not about getting rich fast but rather accumulating wealth little by little.

When considering this system, keep in mind that it requires holding onto investments for an extended time. Some underrated businesses may take time to realize their full eventuality, so be prepared for a long-term commitment.

While it demands tolerance and resources, this approach is less nerve-racking than swiftly-paced trading strategies. The idea is to invest wisely in companies you believe in and let time work in your favor.

Buffett’s strategy also suggests taking advantage of market downturns. Despite short-term market oscillations, historical trends show that markets tend to recover in the long run. Investing in a good company during market struggles may uncover retired openings.

6. Seizing chances When Markets Panic for Smart Investing

Investing when markets are in disquiet can be a smart plan. Market ups and downs are out over the long term. Indeed, during tough moments, literal data shows that markets ultimately recover. The key is to concentrate on the long game rather than seeking quick returns.

A robust company with a history of strong versions is more likely to endure market downturns.

When markets are floundering, stock prices can drop, creating openings to find underrated gem stocks with eventuality for unborn growth.

Still, the challenge lies in choosing a company whose stock has fallen but has the adaptability to rainfall the storm. Imagine a stock map showing a dip during an extremity, like the one caused by COVID-19. Numerous businesses faced challenges during this period, and some indeed questioned their survival. The thing is to avoid investing in companies that might be sinking.

In substance, the strategy involves strategic investing during market fear, taking advantage of lower stock prices while being conservative and opting for companies with the strength to overcome challenges.

Tolerance and careful analysis are crucial to navigating through turbulent request phases and eventually serving from the recovery that generally follows. Overall, these situations will make you ready for your investment journey and help you learn how to invest in stocks like a pro without financial advisor.

Conclusion:

Warren Buffett’s investment principles serve as a precious companion for individual investors seeking to navigate how to invest in stocks like a pro-without financial advisor. Emphasizing a long-term perspective, Buffett advocates for understanding businesses completely before investing and fastening on their natural value.

His renowned rule of “be fearful when others are greedy, and greedy when others are fearful” underscores the significance of contrarian thinking.

To invest like a pro, individuals should prioritize businesses with enduring competitive advantages and sustainable earnings. Buffett’s emphasis on profitable gullies and harmonious cash inflow aligns with a prudent investment strategy.

Also, his aversion to market timing in favor of case value-driven investing reinforces the idea that successful investing is about buying quality companies at affordable prices and preserving them for the long haul.

“How to invest in stocks like a pro-without financial advisor: Warren Buffett’s rules”- conduct thorough exploration, prioritize natural value, and maintain discipline and tolerance. These dateless strategies encourage independent investors to make informed opinions, emphasizing the significance of understanding businesses, seeking natural worth, and embracing a patient, long-term mindset.

By clinging to Buffett’s principles, individuals can navigate the market effectively and strive for success on their own terms.

Personal Experience in Investing Following Warren Buffett’s Rules

Hello! I am Hafsa Ahmed. Embarking on my investing trip, I embraced Warren Buffett’s principles as my mentoring light. Armed with his sagacity, I excavated into active exploration, analyzing fiscal reports and understanding businesses at a basic position. The conception of natural value came into my compass, leading me to investments with solid fundamentals and enduring competitive advantages.

Discipline and tolerance, Buffett’s crucial tenets, tested my resoluteness. During market frenzies, I flashed back to his mantra, “Be fearful when others are greedy, and greedy when others are fearful.” This counsel shielded me from impulsive opinions, supporting the significance of a loyal approach. One memorable investment centered on a company with a wholesome, profitable moat. Despite short-term market oscillations, I held my ground, mirroring Buffett’s unvarying commitment to quality. As the times unfolded, the investment flourished, validating the graces of my case strategy.

Buffett’s principles not only shaped my portfolio but converted my mindset. Investing transcended bare deals; it came a journey marked by adaptability, knowledge, and a profound understanding of businesses.

“How to invest in stocks like a pro-without financial advisor: Warren Buffett’s rules” helps me understand the overall market condition, investment strategies, approaches, etc. Following in the steps of the Oracle of Omaha, my experience in investing underlined the power of applying Buffett’s rules — a passage that continues to unfold with precious assignments at every turn.

FAQs [Frequently Asked Questions]

Can I invest without a financial advisor?

You can invest without a financial advisor. Numerous individuals choose to manage their investments, especially with the wealth of information available online. Still, it’s essential to recognize that while self-directed investing is attainable, seeking guidance from a professional financial advisor can be salutary, especially for those with complex fiscal situations or concrete assets.

How do I buy stocks like a pro?

To buy stocks like a pro, conduct a thorough exploration of companies, prioritize natural value over short-term trends, borrow from a long-term angle, and diversify your portfolio. Be tolerant and disciplined, and stay informed about market directions. Consider seeking advice or learning from seasoned investors to enrich your understanding of the stock request.

Invest in the share market like a pro by channeling in-depth exploration of companies, understanding their fundamentals, and fastening on long-term value. Diversify your portfolio, be patient, and stay chastened. Learn from educated investors, stay informed about market trends, and consider seeking professional advice in a well-rounded way.

Can I buy stock directly without a broker?

You generally can only buy stocks directly with a broker. Brokers act as interposers, easing stock deals on stock exchanges. To invest in stocks, you will be required to open an account with a brokerage platform, where you can set buy and sell orders for stocks and other securities.

What is the number 1 rule of investing?

The number 1 rule of investing is to diversify your portfolio. Spreading investments across diverse means helps manage threats by reducing the impact of poor versions in any single investment. Diversification allows for a more balanced and flexible portfolio, enhancing the eventuality of long-term fiscal success.

References

- Mani. (2023, February 7). Warren Buffett’s rules: Investing in stocks like a pro [guide]. GETMONEYRICH. https://getmoneyrich.com/warren-buffett-3-rules-of-investing/

- Dolan, B. (n.d.). Investing rules the legendary Warren Buffett lives by. Investopedia. https://www.investopedia.com/financial-edge/0210/rules-that-warren-buffett-lives-by.aspx

- James Royal, Ph. D. (n.d.). Warren Buffett’s investment advice: 9 top pieces of wisdom for investing success. Bankrate. https://www.bankrate.com/investing/warren-buffett-top-investment-advice/

- Matthew Frankel, C. (n.d.). How to invest like Warren Buffett. The Motley Fool. https://www.fool.com/investing/how-to-invest/famous-investors/warren-buffett-investments/

Glassman, J. K. (2023, July 30). Warren Buffett advice: Why you should pick businesses, not stocks. Kiplinger.com. https://www.kiplinger.com/investing/why-you-should-pick-businesses-not-stocks